Opinion: Bitcoin failed to hold above $110,000 and risks falling below $106,500

Bitcoin (BTC) fell below $110,000, failing to hold above a key level broken on October 11. The decline coincided with a new round of trade tensions between the US and China and increased volatility amid a lack of signs of a resolution.

Additional pressure was exerted by news of a telephone conversation between the presidents of the United States and Russia.

Against this backdrop, analysts estimate that the market structure is gradually shifting toward bearishness. However, a technical rebound remains possible if certain conditions are met.

Pressure on market structure

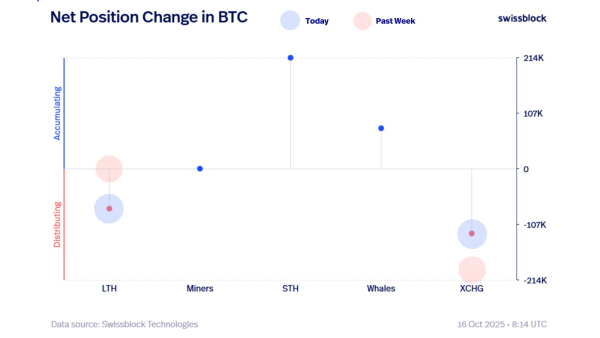

According to Swissblock, market participant behavior has changed. In recent weeks, long-term holders have begun selling assets, although sales remain moderate. In terms of exchange inflows, the leading cryptocurrency is still positive, but at a lower volume.

Change in new Bitcoin positions. Source: Swissblock.

Change in new Bitcoin positions. Source: Swissblock.

Analysts note that the consequences of the weekend liquidations will become apparent in the coming days, as traders finish reshuffling their positions. For now, according to on-chain data, the structure remains stable, with no signs of panic or forced selling.

In the current state, trader Koroush AK has highlighted $109,500 as a new key zone.

“The structure is changing—lower lows and highs are forming. The $109,500–$107,500 zone is a high-risk range, and buyer confidence will only return after a return to the $115,500 level,” he said.

Experts also warn that a break of $110,000 could trigger a rapid decline to $106,474.

At the time of publication, the first cryptocurrency is trading at $108,320, Ethereum (ETH) – at $3,891.

Interestingly, the current collapse has also affected Zcash, a privacy coin that stubbornly bucked the market during large-scale liquidations. However, over the past 24 hours, the asset has actually lost more than 11%, virtually repeating the overall decline with a delay.

On the topic: Ethereum predicted to pull back to $3,800 before a new rally

BTC/USD Technical Analysis. Source: EnzoTheOpp.

BTC/USD Technical Analysis. Source: EnzoTheOpp.

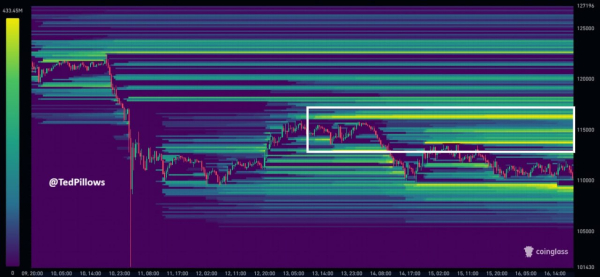

Investor Ted believes that liquidity is concentrated in the $115,000–$118,000 range, where a short squeeze is possible in the event of positive news about US-China negotiations.

On the topic: Trump's dump has pushed the market into a reboot phase — Glassnode

Bitcoin liquidation heat map. Source: Ted.

Bitcoin liquidation heat map. Source: Ted.

Recovery scenarios

Crypto podcast host and influencer Scott Melker noted that Bitcoin has already rebounded 50% from its local lows following its sharp drop on October 10. However, he noted that such rebounds often precede a retest of the lower levels.

Melker added that the RSI is showing a possible bullish divergence, but the signal will only be confirmed if a higher low is formed.

“The market needs time to stabilize after the liquidations. We continue to wait for clear signals,” he noted.

On Topic: October Promises to Be a Strong Month for Bitcoin Again – Scott Melker

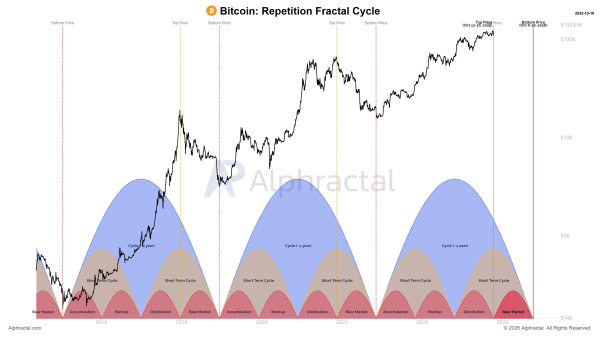

Alphractal founder João Wedson, in turn, noted that the current week could be key for confirming the first cryptocurrency's four-year cycle.

“If the price goes significantly lower, that will prove the model still works,” he said.

Four-Year Cycles of Digital Gold. Source: João Wedson.

Four-Year Cycles of Digital Gold. Source: João Wedson.

On the topic: Bitcoin price will exceed $150,000 if it “breaks the four-year cycle” – Peter Brandt

Gold is displacing Bitcoin

Amid yet another decline in digital assets, prominent cryptocurrency opponent Peter Schiff declared that “gold is eating into Bitcoin's share.” The latter has fallen 32% in ounces since August. According to the economist, the current bear cycle will be “merciless.”

On October 15, he also said that Bitcoin no longer follows gold's dynamics. In response, users noted that Schiff has been making similar statements for a decade—and is still wrong.

Source: cryptonews.net