Bitcoin Breaks Below $100,000: Market Outlook

Bitcoin's recent decline below $100,000 was a significant test of investor confidence and market resilience. The world's largest cryptocurrency quickly recovered, confirming a new psychological support level.

Analysts agree. Short-term fluctuations don't change the long-term trend. It remains unchanged and potentially bullish. Most experts point to pressure from the US government shutdown.

PlanB's Take: Mid-Cycle

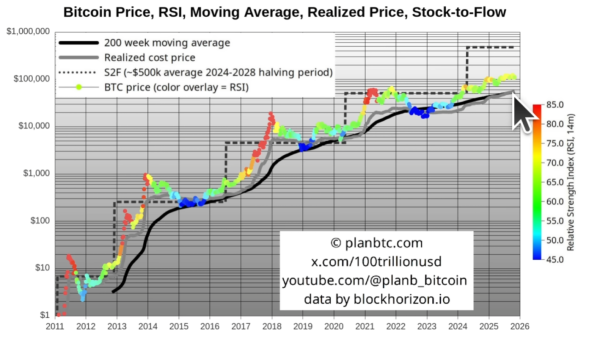

PlanB is the author of the Stock-to-Flow (S2F) model. He interprets a correction as a mid-cycle pause. Bitcoin has held above $100,000 for six consecutive months. This marks a transition from resistance to support.

Bitcoin technical indicators chart. Source: YouTube/PlanB

Bitcoin technical indicators chart. Source: YouTube/PlanB

He argues that the market has not yet reached a state of euphoria, as the RSI is currently at around 66. This is significantly below the overheated levels above 80 in past cycles.

PlanB forecasts growth in the range of $250,000–$500,000 . The condition is a continued price deviation from the realized price. This is typical of sustained bull markets.

Arthur Hayes's Opinion: Hidden Quantitative Easing

Arthur Hayes attributes Bitcoin's short-term weakness to the tightening of US dollar liquidity. Since the US debt ceiling was raised in July, the General Treasury Account (TGA) has increased significantly, resulting in a drain on liquidity in the markets.

$BTC (yellow) -5%, $liq (white) -8% since US debt ceiling raised in July. TGA build up sucked $ out of the system. When US gov shutdown ends, TGA will fall +ve for $liq, and $BTC will rise… and $ZEC will go up MOAR! pic.twitter.com/A9tflGuBHH

— Arthur Hayes (@CryptoHayes) November 5, 2025

However, he foresees a reversal: once the US government reopens and begins spending TGA funds, it will mark the beginning of “hidden quantitative easing.”

He estimates that the Federal Reserve will indirectly increase liquidity through standing repo agreements, expanding its balance sheet without formally announcing quantitative easing.

His formulation: “When the Fed starts cashing politicians' checks, Bitcoin will rise.”

Raoul Pal's View: Liquidity Influx Coming

Raoul Pal's liquidity model reflects a similar dynamic. His Global Macro Investor Liquidity Index (GMI) , which tracks the global supply of money and credit, continues its long-term upward trend.

Pal characterizes the current phase as a “Pain Window,” in which tight liquidity and investor fear are testing investor confidence. Nevertheless, he expects a sharp reversal to occur soon.

I know no one wants to hear bullish ideas and everyone is scared and wants to fling poo at each other… but the Road to Valhalla is getting very close.

If global liquidity is the single most dominant macro factor then we MUST focus on that.

REMEMBER – THE ONLY GAME IN TOWN IS… pic.twitter.com/WXhqd23ec9

— Raoul Pal (@RaoulGMI) November 4, 2025

Treasury spending will inject $250 billion to $350 billion into the market, and quantitative easing will end, followed by interest rate cuts. As global liquidity increases—from the US to China and Japan—Pal asserts, “When this number rises, all numbers rise.”

Current forecast: accumulation phase before expansion

Based on various models, the conclusion is clear: Bitcoin has overcome the correction caused by the liquidity shortage. Large holders continue to buy, technical support remains, and the macroeconomic situation points to a recovery in liquidity.

Short-term fluctuations may persist during the fiscal and monetary policy adjustment process, but structurally, the next stage promotes gradual recovery and accumulation.

If liquidity indicators resume their rally in the first quarter of 2026, both Hayes and Pal suggest that Bitcoin's next rally could start from the same foundation it recently endured—a crash test at $100,000.

Additionally, CryptoQuant data shows that large Bitcoin holders—wallets with balances between 1,000 and 10,000 BTC—added approximately 29,600 BTC over the past week, equivalent to approximately $3 billion.

LATEST: Bitcoin whales added nearly 30,000 BTC this week, worth nearly $3 billion, while retail panic and ETF outflows dominate the headlines.

Data from @cryptoquant_com and analyst @JA_Maartun pic.twitter.com/yXOGsSgkTu

— BeInCrypto (@beincrypto) November 6, 2025

Their combined balance increased to 3.504 million BTC, marking the first significant accumulation phase since September. This wave of buying occurred amid weakening retail investor sentiment and $2 billion in ETF outflows.

Analysts interpret this divergence as a sign that institutional players are quietly accumulating assets, strengthening support for Bitcoin near the $100,000 mark.

The post Bitcoin breaks below $100,000: Market outlook appeared first on BeInCrypto.

Source: cryptonews.net