Short-term holders bought $12 billion worth of BTC — will there be a rally?

The price of Bitcoin (BTC) has fallen 2.3% in the past 24 hours. The coin is trading around $108,800 following the October 10 market crash and a volatile week. Despite attempts to recover, short-term holders (STH) are actively buying back every dip. Their actions could soon have a significant impact on the BTC price.

The sudden accumulation that began after the correction on October 10th indicates growing optimism. The STH accumulation trend coincides with technical signals that, taken together, point to a possible Bitcoin price recovery or even a rally.

How to Buy Cryptocurrency in 2025: A Complete Guide

Short-term holders absorb the fall

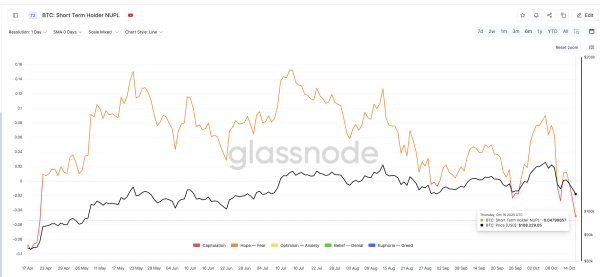

Short-Term Holder Net Unrealized Profit/Loss (NUPL) is a metric that shows whether recent buyers are profiting or losing money. The metric fell to -0.04, its lowest value since April 20, 2025. A negative value indicates that most short-term holders are losing money, which often signals a market bottom or the beginning of a recovery as selling pressure eases.

Short-Term Bitcoin Holders Are in the Loss: Glassnode

Short-Term Bitcoin Holders Are in the Loss: Glassnode

Previously, such lows quickly led to recovery.

- On September 25, when NUPL reached -0.02, Bitcoin rose 4.9%, from $109,000 to $114,300 in just four days.

- On October 11, NUPL fell again to -0.02, and BTC rose 4.1% from $110,800 to $115,300 in three days.

Now, with NUPL even lower and losses deeper, short-term holders appear to be doubling down instead of exiting.

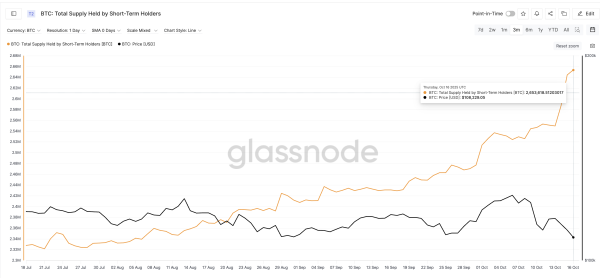

According to Glassnode, the volume held by short-term holders (STH) increased from 2.54 million BTC on October 13 to 2.65 million BTC on October 16—a 4.3% increase in just three days. This means short-term traders added approximately 110,000 BTC (nearly $12 billion at BTC's current price), demonstrating aggressive buying despite the decline. STH volume also reached a three-month high, demonstrating confidence in the short-term outlook.

Short-Term BTC Holders Buy Every Dip: Glassnode

Short-Term BTC Holders Buy Every Dip: Glassnode

This combination of negative NUPL and rising supply typically indicates a quiet accumulation phase as short-term holders prepare for a possible recovery.

7% growth needed for a breakout

The 4-hour Bitcoin chart shows that the BTC price is forming a descending wedge. This is a pattern in which lower highs and lows are compressed into narrowing boundaries, often leading to a bullish breakout.

Since October 11, BTC has made a lower price low, but the relative strength index (RSI), which measures the speed and strength of price movements, has shown a higher low. This is called a bullish divergence, a signal that momentum may be picking up.

To confirm a recovery, Bitcoin must rise by approximately 7.4%, breaking above $115,900 to break out of the wedge. Before that, the price must close above $112,100 and $113,500, two resistance zones that have failed to break during recent recovery attempts.

Bitcoin Price Analysis: TradingView

Bitcoin Price Analysis: TradingView

If Bitcoin breaks above $115,900, it could open the door to $122,500, the next significant resistance level. However, if support at $107,200 fails, BTC could return to its cyclical low near $102,000.

The short-term situation is clear: holders are actively buying, momentum is stabilizing, and key technical patterns suggest selling pressure is easing. But for this to develop into a rally, Bitcoin must hold at $107,000 and close above $115,900. These two levels will determine whether the $12 billion buying wave will turn into something larger.

Source: cryptonews.net