Coinbase: Deleveraging indicates Bitcoin price bottoming out

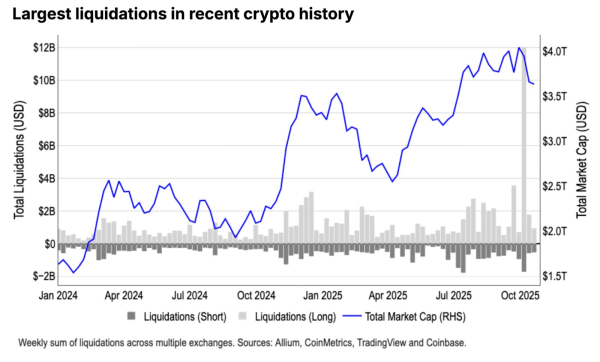

A significant deleveraging following record liquidations on October 10-11 could indicate the formation of a local bottom in the price of Bitcoin (BTC), according to analysts at Coinbase Institutional.

“Excess leverage in the market has been eliminated, fundamentals remain stable, and institutional players are gradually returning. Large players are concentrating on EVM networks, RWAs, and yield protocols. This is not a sign of an exit from the market, but rather a selective return to risk,” the report states.

Long and short position liquidation volume dynamics since the beginning of 2024. Source: Coinbase Institutional.

Long and short position liquidation volume dynamics since the beginning of 2024. Source: Coinbase Institutional.

According to options market data, digital gold prices are expected to be in the $90,000–$160,000 range with a “moderate upside bias” over the next 3–6 months.

The report also notes medium-term factors—a Fed rate cut, improving liquidity conditions, and new regulatory approaches—that could extend the current cycle to 2026.

“Despite the ongoing fear in the crypto market, we believe the October wave of liquidations was more of a prelude to medium- and long-term growth than a weakening one. This paved the way for a possible rebound in the fourth quarter,” the analysts noted.

According to them, it will likely take several months for the market to fully stabilize. In the near term, a gradual recovery can be expected, “rather than a rapid rise to new highs.”

On the topic: Expert expects Bitcoin to crash to $70,000

Mixed signals

A trader nicknamed Mister Crypto has suggested that the current cycle may have peaked, given that the MVRV indicator has reached a downward trend line.

MVRV indicator dynamics against Bitcoin price. Source: Bitbo, Mister Crypto's X-account.

MVRV indicator dynamics against Bitcoin price. Source: Bitbo, Mister Crypto's X-account.

“Don't bet against history,” he warned.

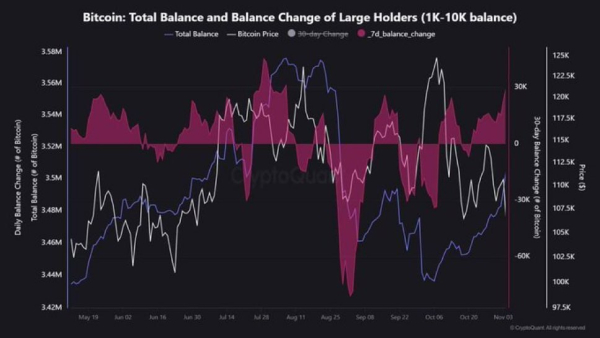

However, the analyst noted that whales purchased 30,000 BTC worth ~$3 billion over the course of the week.

Balance dynamics for addresses with 1,000-10,000 BTC. Source: CryptoQuant, Mister Crypto's X-account.

Balance dynamics for addresses with 1,000-10,000 BTC. Source: CryptoQuant, Mister Crypto's X-account.

“Smart money buys at the bottom!” the investor emphasized.

He also found an outflow of “millions of ETH” from centralized exchanges that has been ongoing since August.

ETH volume dynamics on exchange balances. Source: Mister Crypto's X-account.

ETH volume dynamics on exchange balances. Source: Mister Crypto's X-account.

“What happens next is obvious!” commented Mister Crypto.

Related: VanEck CEO Calls Ethereum a “Wall Street Token”

Source: cryptonews.net