Quantum computers could destroy up to 30% of Bitcoin.

Quantum computing could pose a mortal threat to Bitcoin in the coming years, according to Charles Edwards, founder of investment firm Capriole Invest.

According to him, 20% to 30% of all existing BTC could be hacked by quantum machines within two to eight years, and this cannot be prevented.

What is a quantum computer and how did it become a threat to cryptocurrencies?

A threat to old wallets

Edwards explained that these are old P2PK (pay-to-public-key) addresses used in the early days of the network. Such wallets are vulnerable to attacks that will become possible once quantum computers can crack private keys. Among the vulnerable wallets, he said, are wallets believed to belong to Satoshi Nakamoto, which hold approximately $125 billion in bitcoins.

“In 2-8 years, quantum machines will be able to take 20-30% of all Bitcoin, and we won't be able to stop it. These are P2PK addresses, including those belonging to Satoshi, and many other old or lost coins,” Edwards wrote.

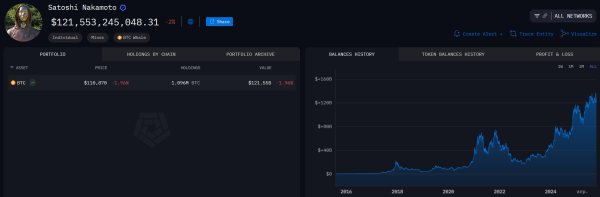

Satoshi Nakamoto's wallet balances. Source: Arkham

Satoshi Nakamoto's wallet balances. Source: Arkham

Read also: Why Satoshi Nakamoto's Bitcoin Hasn't Moved for 15 Years

A Dilemma for the Bitcoin Community

According to Edwards, the Bitcoin community faces a difficult decision:

- Leaving everything as is and allowing quantum hackers to gain access to old coins could lead to a market collapse worth hundreds of billions of dollars.

- Or agree in advance on a migration period during which owners can transfer their funds to quantum-protected addresses. If this doesn't happen, all such assets must be burned.

“Bitcoiners face a painful choice. If 30% of the supply were suddenly unlocked, it could destroy Bitcoin's reputation as 'sound money' and undermine confidence in the 'trust the code' principle,” Edwards noted.

Another solution

Following Edwards's post, one of the discussion participants proposed a third option. He suggested that the community could not only establish a migration deadline for vulnerable coins but also impose a limit on how quickly they can be released into circulation.

“We could set a migration period for these coins, and if they aren't transferred to quantum-protected addresses on time, introduce a time or block limit on spending. For example, allow spending only one coin per block to avoid a market crash,” the user suggested.

However, Edwards rejected the idea, calling it a compromise that does not solve the problem.

“In my view, this is not a viable solution, but a watered-down mixture of options A and B that will leave no one happy,” he replied.

The quantum threat is becoming a reality

Cryptocurrency experts have been warning for several years that the development of quantum technologies could threaten modern cryptographic algorithms. Most modern Bitcoin addresses use more secure schemes (P2PKH, P2WPKH, P2TR), but early wallets created before 2010 remain a weak point in the network.

Source: cryptonews.net