Galaxy analyst notes declining interest in Bitcoin

AI and quantum technologies have captured investors' attention.

Positive sentiment towards the world's first cryptocurrency has faded slightly, given the sentiment at the start of the year, but investor interest will return later, said Alex Thorne, head of research at Galaxy Digital, in an interview with CNBC.

“The focus will shift back to Bitcoin, as it always does,” he noted.

According to Thorne, digital gold became the “deal of the year” after Donald Trump's victory in the US presidential election. However, market participants have now moved on to other areas.

The expert highlighted the areas of artificial intelligence, nuclear energy, quantum technologies, and gold.

“There were a lot of other sources of profit in this cycle that discouraged investment in Bitcoin,” Thorne emphasized.

At the same time, many of the areas that are “distracting” investors' attention, especially gold, are the same sectors to which the first cryptocurrency is often compared, according to researcher Galaxy.

Thorne remains optimistic about Bitcoin's long-term price. However, he recently lowered his 2025 price target from $185,000 to $120,000.

Bitcoin is losing its dominance

As the leading cryptocurrency lags, altcoins may take the lead. According to analyst Matthew Hylan, BTC's dominance chart “has been looking bearish for weeks.”

The reason why you should have confidence in the Alt coin price action is because the #BTC Dominance chart looks bearish and has looked bearish for many weeks

The downtrend is favorable to continue therefore this relief rally has been a dead cat bounce in a downtrend: https://t.co/QgduZZ3Qxq pic.twitter.com/5RlgY3CRG2

— Matthew Hyland (@MatthewHyland_) November 8, 2025

“The downtrend is favorable for continuation, so this light rally was a 'dead cat bounce' during the correction,” he explained the recent short-term rise in the indicator.

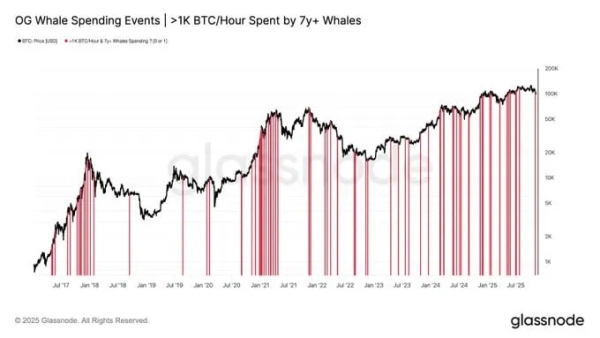

At the same time, “veteran whales” are increasing their Bitcoin sales. Glassnode specialists showed a chart showing an increased frequency of large transactions—the red lines indicate the activity of wallets over seven years old, spending over 1,000 BTC per hour.

Source: X.

Source: X.

“The key difference in this cycle is that such large expenditures by first-generation whales occur more frequently. This indicates a stable distribution,” the researchers explained.

As a reminder, whales have sold 32,500 BTC since October 12, while small investors have been actively buying on the decline. According to Santiment analysts, this divergence in behavior is a warning sign for the asset.

Source: cryptonews.net