JPMorgan expects Bitcoin to rise to $165,000 by year-end

According to analysts at JPMorgan, Bitcoin is significantly undervalued compared to gold when adjusted for volatility.

The Bitcoin-to-gold volatility ratio has fallen below 2.0, meaning Bitcoin now requires approximately 1.85 times more risk capital than gold, according to a report from JPMorgan analysts. Based on this ratio, the flagship crypto asset's current market capitalization of $2.3 trillion would increase by approximately 42%. This implies a theoretical Bitcoin price of $165,000 to match the $6 trillion in private gold investment through ETFs, bars, and coins.

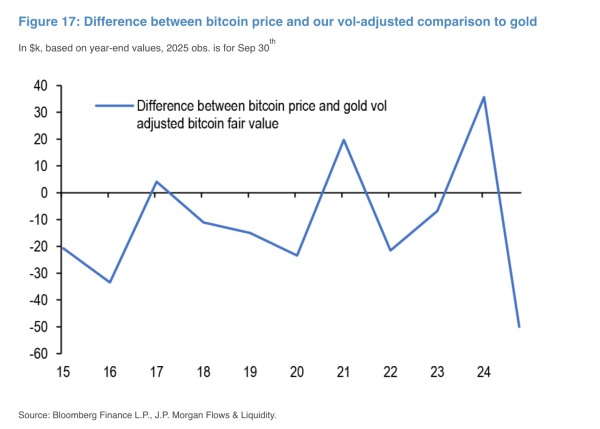

The bank's analysts noted that the gap in Bitcoin's valuation has narrowed from $36,000 at the end of 2024 to around $46,000 today compared to gold's volatility-adjusted level.

Thus, this mechanical exercise could lead to a significant increase in the Bitcoin price, they said.

The projected rise comes amid what JPMorgan analysts call growing interest in “depreciation trading” and rising investor demand for alternative stores of value.

Total inflows into spot Bitcoin and gold ETFs have risen sharply over the past year. Inflows into BTC funds increased in early 2025 but declined in August, while inflows into gold ETFs have recently increased, narrowing the gap between the two.

Source: cryptonews.net