Opinion: Panic-selling of 148,000 BTC has increased the risk of Bitcoin falling below $90,000.

Main:

-

New digital gold holders sold over 148,000 BTC at a loss on November 14.

-

A break below the year-opening price of $93,000 could trigger a move into the zone below $90,000.

Bitcoin (BTC) continued to fall amid weakening sentiment following the end of the US shutdown. A new round of selling came from investors who entered the market at its peak.

This has forced investors and traders to reconsider their risks and remain cautious, with the latest buyers already selling their bitcoins at a loss.

New holders are recording losses

On November 17, the price of the leading cryptocurrency fell to $92,000, almost completely erasing its gains since the beginning of the year. The end of the 43-day US shutdown failed to improve market sentiment, and investors reassessed their risks. The last buyers began selling the asset at a price below its cost.

Bitcoin has retreated 25% from its all-time high of $126,000, reached on October 6. A break below its 50-week moving average and a weekly close below $100,000 for the first time in six months have heightened market caution.

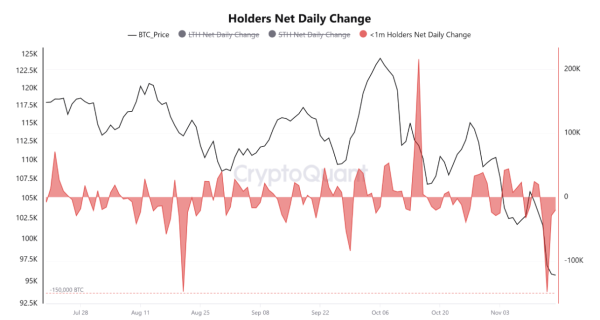

On-chain data from CryptoQuant showed that more than 148,000 BTC held by retail investors and “newbies”—holders whose wallets contain less than 1 million BTC and have held the coins for less than a month—were sold at a loss on November 11.

CryptoQuant analyst Crazzyblockk noted that the sell-off occurred at around $96,853, which is significantly below their average purchase price of $102,000–$107,000.

He emphasized that this was not profit-taking, but a large-scale sale with a clear loss.

On the topic: Bitcoin is not a “magic anarcho-capitalist Swiss army knife” — Nick Szabo

Daily net inflow and outflow of Bitcoin holders. Source: CryptoQuant.

Daily net inflow and outflow of Bitcoin holders. Source: CryptoQuant.

Glassnode data showed that short-term holders sent 20,175 BTC to exchanges at a loss on November 13. This figure increased to 39,034 BTC the following day, coinciding with a 13.5% price drop to $92,900 from $107,500.

The volume of Bitcoin transfers from short-term holders to exchanges with fixed losses. Source: Glassnode.

The volume of Bitcoin transfers from short-term holders to exchanges with fixed losses. Source: Glassnode.

This surge in activity demonstrates the typical behavior pattern of speculators who sell assets in panic during a period of decline.

According to the analyst, many of these investors are experiencing their first major decline and are choosing to lock in losses to avoid further declines.

“The loss of 148,000 BTC can be seen as a clearing of impatient capital from the market. This creates an opportunity for coins to move from panic buyers to long-term buyers at a reduced price, creating a more stable base for the future,” he added.

On the topic: Has Bitcoin returned to neutral mode? The influx of coins onto exchanges coincided with a rise in stablecoin stocks.

Bitcoin could fall below $90,000 before bouncing back

The break below the 50-week moving average has many analysts talking about the possibility of a deeper pullback.

Analyst Jelle believes the price is in another correction within Bitcoin's overall upward trend. He suggested the market could move sideways until the end of the year or correct by another 5% and then begin to reach new highs.

“A 5% drop from current levels would take the BTC/USD pair to the $89,300 area,” he said.

BTC/USD weekly chart. Source: Jelle.

BTC/USD weekly chart. Source: Jelle.

An AlphaBTC analyst believes the leading cryptocurrency is poised for a local rebound, but another dip below $90,000 is likely. He believes a close below the yearly open of $93,300 could lead to a decline toward April lows around $74,000.

Meanwhile, Polymarket forecasts show mixed expectations: a $98,000 price scenario by the end of the week is estimated at 70%, a 55% chance of closing below $92,000, and a 35% chance of reaching $90,000. The probability of returning above $100,000 remains at 50%.

On the topic: Polymarket has accepted bets on Bitcoin rising to $1 million before the release of GTA VI.

This article does not contain investment advice or recommendations. Every investment and trading decision involves risk, and readers should conduct their own research before making decisions.

Source: cryptonews.net