Bitcoin has fallen below $100,000.

Spot BTC ETFs saw inflows for the first time in eight days

On November 7, the price of the first cryptocurrency fell below the psychological mark of $100,000 – to ~$99,900.

Binance BTC/USDT hourly chart. Source: TradingView.

Binance BTC/USDT hourly chart. Source: TradingView.

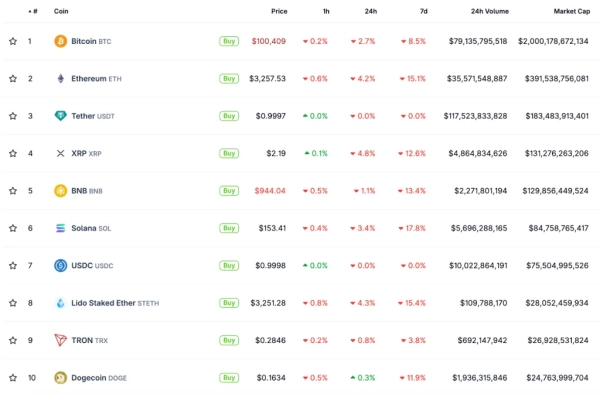

Bitcoin has fallen 2.9% in the past 24 hours and 8.9% over the past week. At the time of writing, the coin is trading at $100,110.

According to trader Ardi, after breaking through $100,000, the next key support level is at $98,000.

$BTC falls below $100K again 🚨

Engulfing 4H candle sends Bitcoin to test the $100K support.

Needs to hold above, otherwise likely flush into ~$98K critical support. pic.twitter.com/LD5vzzzuvz

— Ardi (@ArdiNSC) November 7, 2025

Earlier, CryptoQuant contributors from XWIN Research pointed to a local bottom for digital gold around $100,000, citing the MVRV indicator. They cited a price range of $99,000-$101,000 as the pivot point.

Ethereum's price has fallen 4.6% in the past 24 hours and 15.7% over the past seven days. At the time of writing, the second-largest cryptocurrency by market cap is trading around $3,200.

Binance ETH/USDT hourly chart. Source: TradingView.

Binance ETH/USDT hourly chart. Source: TradingView.

Almost all of the top 10 cryptocurrencies by market capitalization declined. The exception was meme coin Dogecoin, which rose by 0.3%.

Source: CoinGecko.

Source: CoinGecko.

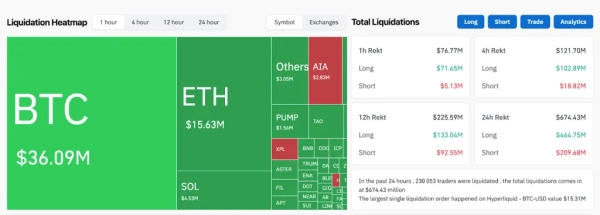

Amid the correction over the past hour, positions worth $76.8 million were liquidated. The 24-hour figure reached $674.3 million.

Source: CoinGlass.

Source: CoinGlass.

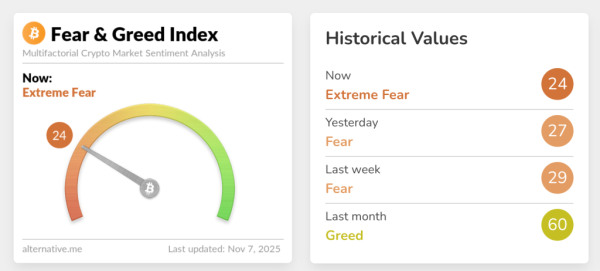

The cryptocurrency Fear and Greed Index is at 24, the “extreme fear” zone.

Source: Alternative.me.

Source: Alternative.me.

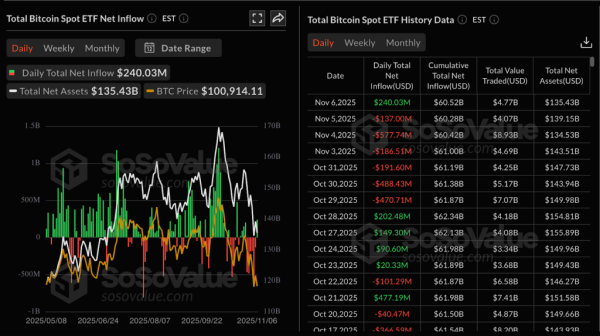

ETF inflows have resumed.

The price of Bitcoin is falling despite a return of inflows into exchange-traded funds based on the asset. At the end of the last trading session, spot BTC ETFs attracted $240 million after six days of outflows.

Dynamics of outflows and inflows into spot Bitcoin ETFs. Source: SoSoValue.

Dynamics of outflows and inflows into spot Bitcoin ETFs. Source: SoSoValue.

The largest share came from IBIT from BlackRock — $112 million. FBTC from Fidelity ($61 million) and ARKB from Ark & 21 Shares ($60 million) also remained in the black.

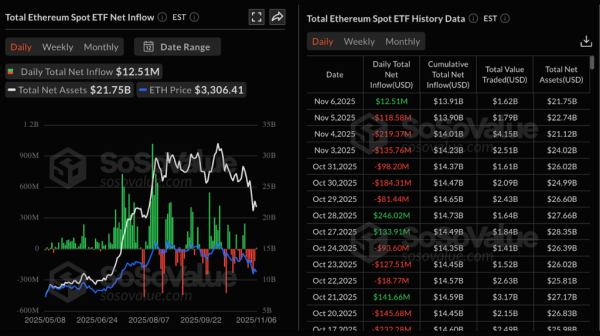

$12 million flowed into Ethereum-focused instruments. BlackRock's ETHA fund also led the way, raising $8 million.

Ethereum spot ETF outflow and inflow dynamics. Source: SoSoValue.

Ethereum spot ETF outflow and inflow dynamics. Source: SoSoValue.

Fidelity's FETH and Bitwise's ETHW raised $4 million and $3 million, respectively.

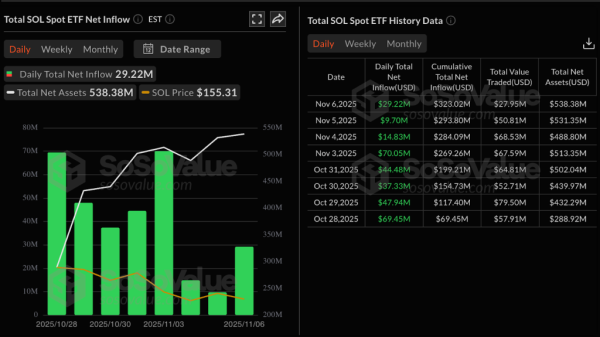

Spot Solana ETFs have seen inflows for the eighth consecutive day, reaching $29 million in the past trading day. Since launch, these instruments have received a total of $323 million.

Dynamics of outflows and inflows into spot Solana ETFs. Source: SoSoValue.

Dynamics of outflows and inflows into spot Solana ETFs. Source: SoSoValue.

The segment is currently represented by two players: BSOL from Bitwise and GSOL from Grayscale.

As a reminder, JPMorgan analysts predicted Bitcoin would rise to $170,000.

A trader going by the nickname Ash Crypto has discovered a “bear trap” in Ethereum's price action.

Source: cryptonews.net