ARK Invest identified Bitcoin's December growth drivers.

The return of liquidity to markets and further easing of the Federal Reserve's monetary policy could contribute to a recovery in the price of the leading cryptocurrency in December, according to analysts at ARK Invest.

https://t.co/A1PDSrCSZd

— ARK Invest (@ARKInvest) November 26, 2025

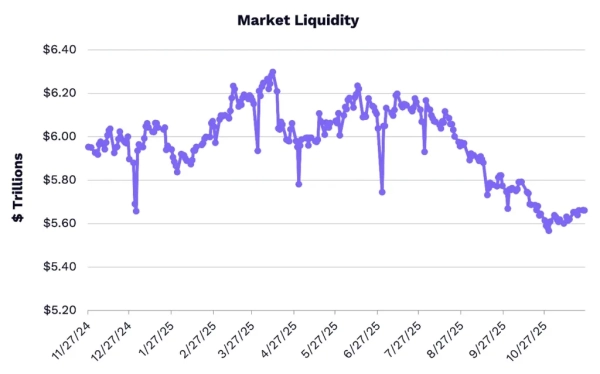

According to them, liquidity reached a multi-year low of $5.56 trillion on October 30. The US shutdown, which lasted a record 43 days, resulted in an outflow of $621 billion.

However, the government reopening has already freed up about $70 billion, with another $300 billion expected to return to markets over the next five to six weeks.

Source: X/ARK Invest.

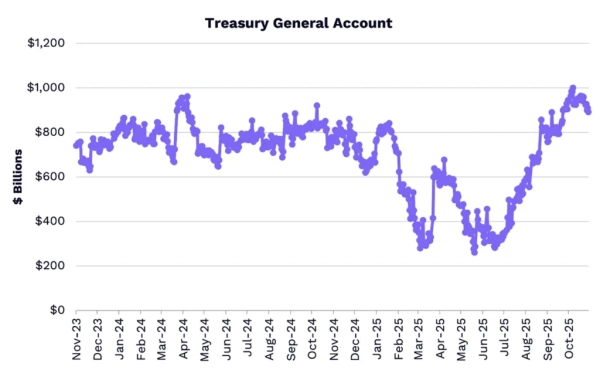

Source: X/ARK Invest.

The Treasury's account remains at a high level of $892 billion against the normalized level of ~$600 billion.

Source: X/ARK Invest.

Source: X/ARK Invest.

“This means that significant liquidity is still ready to return,” the experts noted.

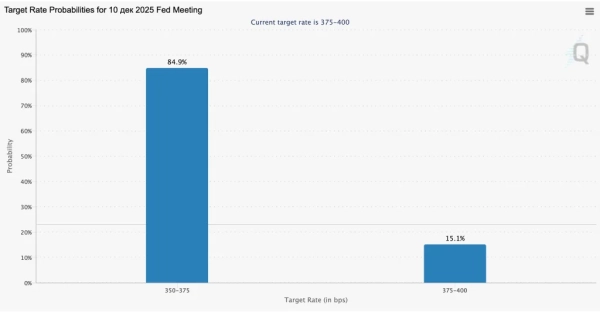

Improving conditions coincided with hints of a further interest rate cut. Investors estimate the probability of such an outcome at 84.9%.

Source: CME FedWatch.

Source: CME FedWatch.

US macroeconomic data strengthens the case for monetary easing, analysts concluded.

ARK Invest CEO Cathie Wood also emphasized that the “liquidity pressure” limiting growth potential should “reverse in the next few weeks.” She noted that she maintains a bullish price forecast despite the correction and the growing popularity of stablecoins.

In this recent webinar, I discuss why the liquidity squeeze that has hit #AI and #crypto will reverse in the next few weeks, something the markets seemed to buy, and why AI is not in a bubble. The 123% increase noted below was in Palantir's US commercial business last qtr.

Watch… https://t.co/GdBZtEQcxM

— Cathie Wood (@CathieDWood) November 26, 2025

In Wood's most optimistic scenario, he expects Bitcoin to reach $1 million by 2030. His baseline estimate is $650,000.

“Improving risk appetite”

On November 27, the leading cryptocurrency rose above $91,000 after falling to its lowest levels since April, around $80,000.

Analysts at QCP Capital attributed the recovery to improved risk appetite, pointing to rising stock markets and the likelihood of the Federal Reserve easing monetary policy. However, threats remain: according to experts, most Fed members remain neutral or opposed to a rate cut.

“With no other significant events, market attention is focused on jobless claims data and the ADP report due later this week,” they added.

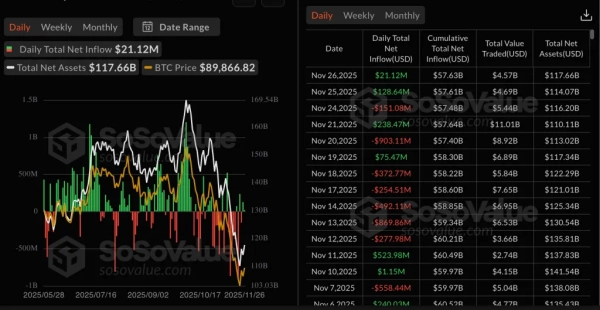

The potential delisting of Strategy from the S&P 500 and continued outflows from spot ETFs could also bring back bearish sentiment and trigger sell-offs.

Despite two days of $129 million in inflows, the overall trend remains negative. Since the beginning of November, ETFs have lost $3.5 billion—the second-worst performance since their launch.

Dynamics of outflows and inflows into spot Bitcoin ETFs. Source: SoSoValue.

Dynamics of outflows and inflows into spot Bitcoin ETFs. Source: SoSoValue.

The options market is also showing caution. Major investors believe Bitcoin will remain sideways and is unlikely to rise above $120,000 by the end of the year.

“A rally to $95,000 will likely face ETF-related selling, which will exacerbate the sideways trend. On the other hand, the $80,000-$82,000 zone remains key support after the recent 'clearance.' Cryptocurrencies continue to trade as a reflection of overall market risk appetite, remaining firmly in the hands of macro-focused investors,” the analysts concluded.

At the time of writing, digital gold is trading at ~$90,700.

Binance BTC/USDT hourly chart. Source: TradingView.

Binance BTC/USDT hourly chart. Source: TradingView.

As a reminder, K33 analysts have called the current Bitcoin price suitable for long-term purchases.

Source: cryptonews.net