Bitcoin Miners Sell Coin, Put Pressure on BTC Price

Bitcoin price has been under pressure since hitting a record high of $123,731 on August 14. BTC is currently trading at $113,167, down 10% from last week.

The price drop coincided with active selling by miners, raising concerns about further declines.

BTC Miners Sell Stocks

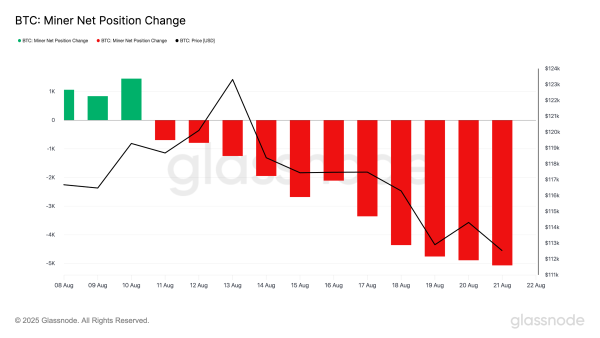

Bitcoin miners' net position has fallen to its lowest in a year, according to Glassnode. The metric, which tracks the 30-day change in the amount of BTC held by miners' addresses, fell to -5,066 on August 21, the lowest since December 2024.

Change in net position of BTC miners. Source: Glassnode

Change in net position of BTC miners. Source: Glassnode

The decline in this indicator indicates increased selling by miners, one of the most influential groups in the market. Constant outflows from their wallets can put pressure on prices, especially when the market cannot cope with the additional supply. This threatens to intensify the downward trend and increase the likelihood of significant short-term corrections.

ETF outflows reach $1.5 billion

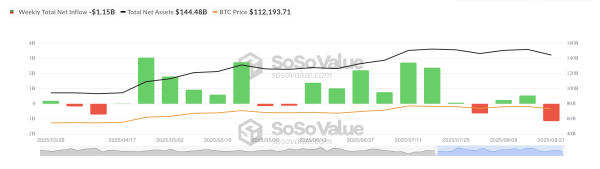

Institutional investors using ETFs to gain exposure to BTC are adding to the pressure on the market. According to SosoValue, $1.51 billion was withdrawn from these funds in a week, which could be the largest weekly outflow since late February.

Net Inflows into Spot Bitcoin ETFs. Source: SosoValue

Net Inflows into Spot Bitcoin ETFs. Source: SosoValue

The decline in capital inflows from ETFs creates additional challenges for the asset. This could amplify the impact of miner selling and slow the recovery in the near term.

BTC Forecast: Possible Drop to $107,000

At the time of writing, BTC is trading above the $111,961 support level. If miners continue to sell and capital inflows into the BTC ETF decline, the coin risks breaking this support and falling to $107,557.

BTC Price Analysis. Source: TradingView

BTC Price Analysis. Source: TradingView

However, the growth in demand for BTC can change this negative scenario. If traders and miners start accumulating coins, reducing their sale, BTC can recover and rise to $ 115,892.

Source: cryptonews.net