CoinShares has refuted the idea that Bitcoin lacks liquidity.

The popular community thesis about the first cryptocurrency's liquidity crisis is not in line with reality, stated Christopher Bendiksen, head of Bitcoin research at CoinShares.

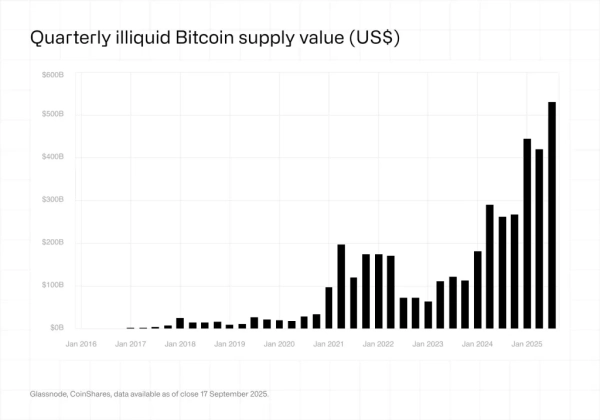

The expert analyzed two key arguments: the decline in digital gold balances on exchanges and the increase in coins in illiquid UTXOs . He pointed out a misinterpretation: when assessing liquidity, it's important to consider not the number of coins, but their dollar value.

Bitcoin liquid supply price chart, quarterly. Source: CoinShares.

Bitcoin liquid supply price chart, quarterly. Source: CoinShares.

“Even as the number of liquid bitcoins in individual units decreases, their total value continues to grow. […] As can be seen [in the chart above], it increases at almost the same rate as the illiquid supply, since the determining factor here is price,” Bendiksen explained.

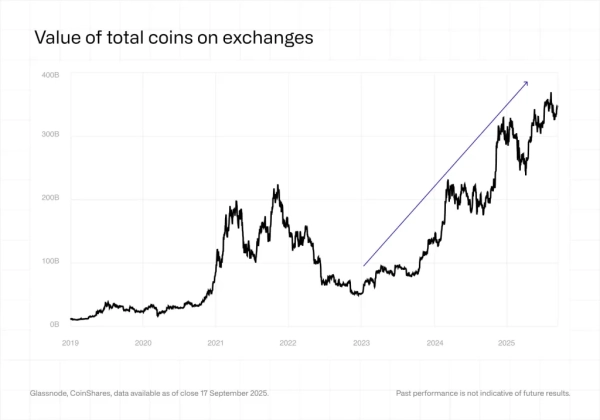

The expert also created a chart of the total value of coins on exchanges, which indicates that there is no liquidity problem:

Source: CoinShares.

Source: CoinShares.

“The amount of available liquidity is almost double what it was at the peak of the last bull cycle, and a new major source has been added to this: Bitcoin ETFs traded on the Nasdaq,” he noted.

According to his calculations, a sharp price rally would require investors to buy more than a million coins annually at current prices. Only such a level of demand could create a shortage and trigger a surge in demand.

ETFs have become a key source of liquidity for Bitcoin.

“There will always be enough coins”

Bendiksen believes that “any amount of the first cryptocurrency will be sufficient to satisfy any dollar demand.” He cited the possibility of digital gold being infinitely divisible (for example, into satoshi).

In his opinion, the idea of liquidity contracting to the levels described by some experts “appears out of touch with reality.” The only “God Candle” scenario is a collapse in demand for the US dollar as a base currency. While such an outcome is possible historically, it is unlikely in the foreseeable future, the analyst emphasized.

“Meanwhile, with Bitcoin's price steadily rising and long-standing holders slowly selling in response to new demand during each price rally, there appears to be enough coins for everyone at any prevailing rate,” he concluded.

As a reminder, a trader using the pseudonym CrypNuevo suggested that digital gold could form a bottom at $101,000.

Source: cryptonews.net