Bitcoin Miner Shares Fall as Sector Suffer Massive Losses

Bitcoin mining stocks posted significant declines on Wednesday, with most major publicly traded firms in the space falling.

Bitcoin Mining Stocks Slip Across the Board

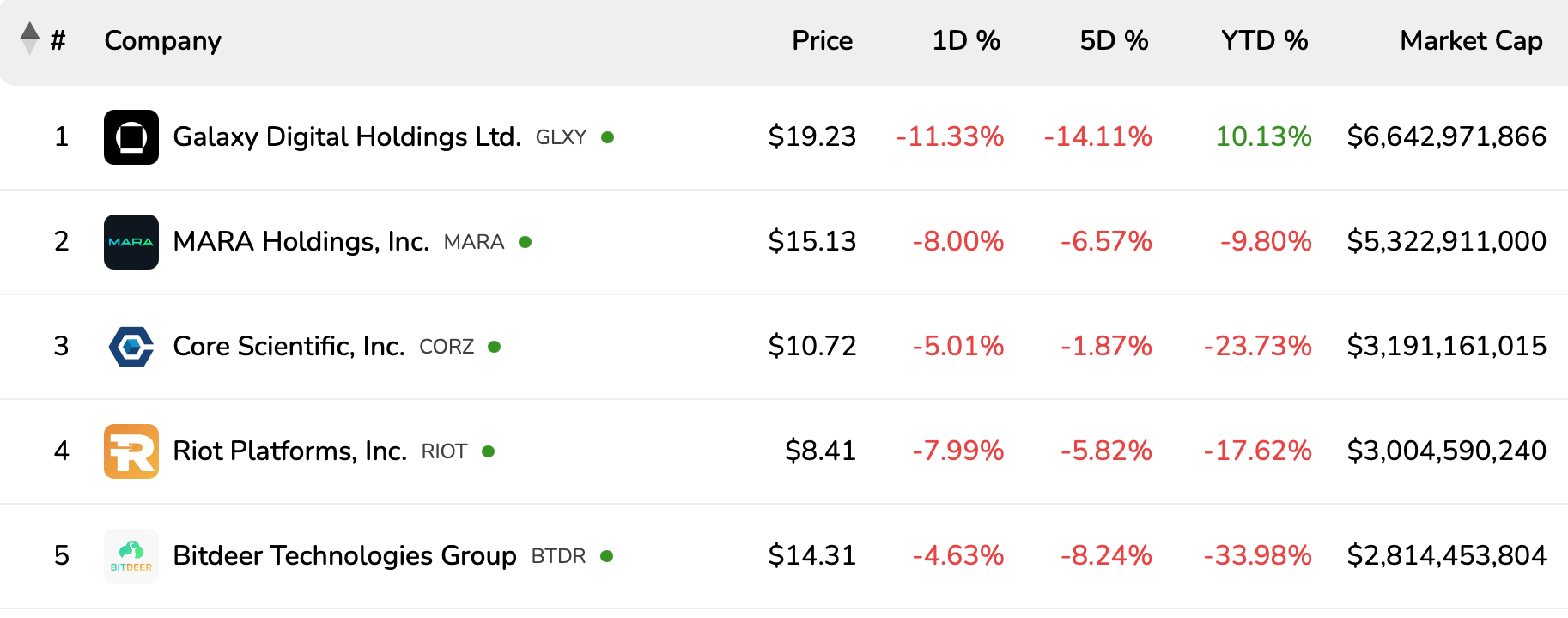

Galaxy Digital Holdings, which has a market cap of $6.64 billion, has lost 11.33% of its shares on the day and 14.11% over the past five sessions, although its value has increased by 10.13% year-to-date. In second place is bitcoin miner MARA Holdings, valued at $5.32 billion, which also fell 8% on Wednesday and is down nearly 10% year-to-date.

The five largest publicly traded bitcoin mining companies by market cap, according to bitcoinminingstock.io as of 11:30 a.m. ET.

The five largest publicly traded bitcoin mining companies by market cap, according to bitcoinminingstock.io as of 11:30 a.m. ET.

Of the twelve largest public miners, Core Scientific, Riot Platforms, and Bitdeer Technologies have all seen significant one-day losses of over 4%, with year-to-date figures showing even steeper declines. Bitdeer is currently down nearly 34% year-to-date, while Riot has lost 17.62% and Core Scientific has lost 23.73%.

Only a few companies have posted gains over the past five sessions. Northern Data AG has been an outlier, up 9% today and 12.52% over the past week. Despite these short-term gains, it remains the biggest laggard since the start of the year, down 35.81% against the US dollar.

Cleanspark has shown solid results with a slight gain of 0.02% year-to-date despite a 6.57% loss in today's trading session. IREN Limited has shown a slight five-month gain of 1.45%, but its year-to-date results are still negative.

Smaller market cap companies like Terawulf and Cipher Mining continued to trade below $4 per share and remain deeply in the red year to date, down more than 28% and 34%, respectively.

The inconsistent performance of Bitcoin mining stocks suggests the market is facing cost pressure. Short-term rallies in individual companies may indicate speculative buying, but sustained losses elsewhere reflect broader concerns about profitability and growth prospects.

Given the ongoing volatility, investors may want to focus more on operational efficiency and capital sustainability than on simple exposure to the Bitcoin mining market.

Source: cryptonews.net