These two factors are putting bearish pressure on the price of Bitcoin (BTC)

This month's weak Bitcoin price performance has sparked a wave of pessimism among institutional investors, increasing the likelihood of a loss-making September.

On-chain data also shows that miners are reducing their holdings, putting further pressure on the already struggling cryptocurrency.

Bitcoin is under pressure from miner sales.

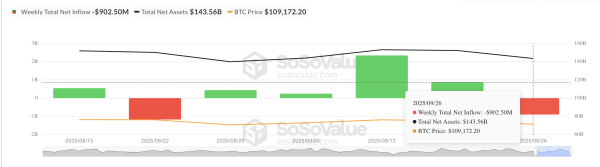

The steady outflow of funds from Bitcoin spot ETFs reflects waning institutional investor interest. According to Sosovalue, $903 million was withdrawn from these funds between September 22 and 26, indicating capital is leaving the market.

The correlation between ETF flows and the BTC price has always been strong. In July, the coin surpassed $120,000 thanks to monthly ETF inflows exceeding $5 billion. Current outflows are in stark contrast, indicating a decline in institutional investor interest and participation since mid-year. This trend could lead to a further decline in Bitcoin if institutional investors continue to withdraw capital.

Total net inflows into Bitcoin spot ETFs. Source: SosoValue

Total net inflows into Bitcoin spot ETFs. Source: SosoValue

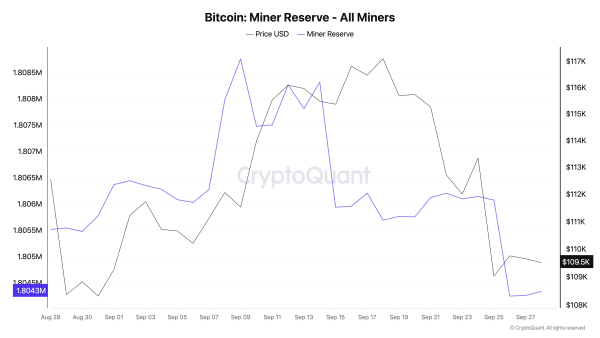

On-chain data shows that miners are selling BTC rather than accumulating it, reinforcing the bearish outlook for the coin. According to CryptoQuant, miner reserves total 1.8 million BTC, down 0.24% since September 9.

Miners' reserves show how much BTC they hold in their wallets before selling. When reserves fall, it means miners are selling their assets to make money or cover expenses. This behavior increases the coin's supply on the market, which can put pressure on the BTC price.

Bitcoin Miner Reserve. Source: CryptoQuant

Bitcoin Miner Reserve. Source: CryptoQuant

BTC Forecast: Possible Decline to New Lows

If BTC spot ETFs continue to see outflows and miners continue selling, the coin's price risks falling to $107,557.

BTC Price Forecast. Source: TradingView

BTC Price Forecast. Source: TradingView

However, if demand increases sharply and market sentiment improves, the BTC price will have a chance to rise above $110,034 and reach $111,961.

Source: cryptonews.net