The whale who accurately predicted the October crash is now betting on another Bitcoin crash.

A crypto whale who recently made over $197 million during the October market crash has doubled down on his efforts, placing a major bet on Bitcoin (BTC) to fall.

This move comes amid Bitcoin's fragile recovery since its mid-October crash. The cryptocurrency is showing signs of resilience amid persistent volatility.

Cryptocurrency lost $500 million in a day: BTC's fall led to mass liquidations.

Return of the Short: BitcoinOG Makes a Big Bet Against Bitcoin

BeInCrypto previously reported on a major investor (whale) who held significant short positions in Bitcoin and Ethereum (ETH). This strategy generated significant profits during the October downturn amid market panic. Notably, the investor earned over $160 million in just 30 hours. This strategy generated significant profits during the October downturn amid market panic. Notably, the investor earned over $160 million in just 30 hours during the October downturn, generating significant profits during a period of market panic.

According to a blockchain analytics company, the whale was active again this week. Initially, he transferred $30 million in USDC to Hyperliquid via wallet (0xb317). He then opened a short position of 700 bitcoins with 10x leverage, equivalent to approximately $75.5 million. He has since expanded this position, signaling a renewed bet against the market.

According to Lookonchain, this Bitcoin investor completely closed all of his short positions on Hyperliquid on October 15th, securing a profit of over $197 million across two wallets. However, despite these massive gains, the trader returned to the market just a few days later.

According to the blockchain analytics company, the whale was active again this week. Initially, it transferred $30 million in USDC to Hyperliquid via wallet (0xb317). The investor then opened a short position of 700 bitcoins with 10x leverage, equivalent to approximately $75.5 million. The investor has since expanded this position, signaling a resumption of its bet against the market. The investor opened a short position of 700 bitcoins with 10x leverage, worth approximately $75.5 million. The investor has since expanded this position, signaling a resumption of its bet against the market.

“The $10B whale on Hyperunit, who made $200M short during the China tariff crash, just DOUBLED his BTC short position,” Arkham posted.

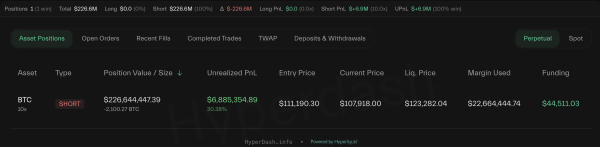

According to the latest Hyperdash data, this investor's active short Bitcoin position is valued at $226.6 million, with 10x leverage. The liquidation price is set at $123,282. Furthermore, the position currently shows an unrealized profit of approximately $6.8 million.

Bitcoin OG Whale Short. Source: Hyperdash

Bitcoin OG Whale Short. Source: Hyperdash

In addition to leveraged bets, Lookonchain noted that the trader is also selling Bitcoin,

“Since the market crash on November 10th, he has transferred 5,252 BTC ($587.88 million) to Binance, Coinbase, and Hyperliquid,” the company said in its report.

Bulls vs. Bears: Who Will Win as Bitcoin Prepares for Its Next Move?

However, not all traders share the bearish sentiment. For example, yesterday, the largest cryptocurrency recovered slightly, reaching over $114,000. Meanwhile, gold, on the contrary, fell before stabilizing around $108,000. Moreover, technical signals and possible capital rotation are inspiring optimism among analysts. As a result, they predict a rapid rise in Bitcoin and altcoins.

This positive outlook is also reflected in the bullish actions of several traders. Lookonchain highlighted four investors who recently bet on the market's growth.

- 0x89AB transferred $9.6 million USDC to Hyperliquid. He then bought 80.47 BTC (approximately $8.7 million) and opened a long position with 6x leverage for 133.86 BTC (approximately $14.47 million).

- 0x3fce added $1.5 million USDC, increasing his long Bitcoin position to 459.82 BTC (approximately $49.7 million).

- 0x8Ae4 contributed $4 million USDC to open long positions in Bitcoin, Ethereum, and Solana.

- 0xd8ef transferred $5.44 million USDC and bet on Ethereum's growth.

So, while investors are taking opposing positions, the coming days will show who's right. Will the whale betting on a fall win, or the traders counting on a market recovery?

Source: cryptonews.net