The Central Bank called Bitcoin the least profitable asset in August. How it was calculated

Russia's Central Bank deemed Bitcoin the least profitable asset in August, but the leading cryptocurrency remains the leader in 12-month profits

Russia's Central Bank deemed Bitcoin the least profitable asset in August, but the leading cryptocurrency remains the leader in 12-month profits

The Bank of Russia included Bitcoin (BTC) in the new edition of the Financial Market Risk Review in the comparative table of asset returns on investments in rubles. The list included Russian market instruments, as well as gold, US government bonds and other assets.

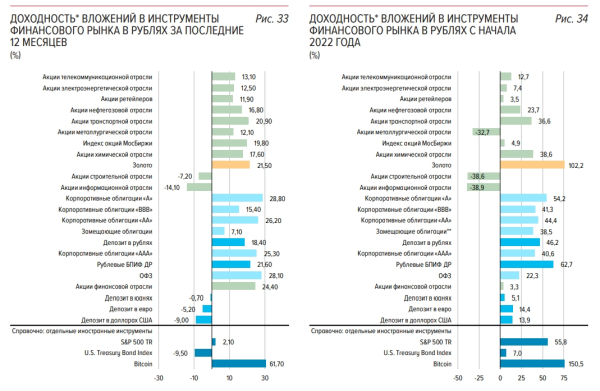

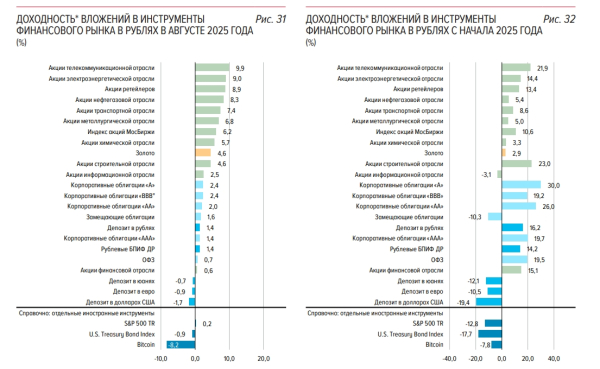

Return on investment in Russian financial market instruments. Source: Bank of Russia

Return on investment in Russian financial market instruments. Source: Bank of Russia

According to the regulator's calculations, Bitcoin, when invested in rubles, has shown the highest return over the past 12 months (61.7%) and since the beginning of 2022 (150.5%). However, in August, it turned out to be the least profitable of all the presented assets when calculated in rubles (minus 8.2%). Since the beginning of 2025, its return has also remained negative (minus 7.8%).

rbc.group Return on investment in Russian financial market instruments. Source: Bank of Russia

Return on investment in Russian financial market instruments. Source: Bank of Russia

In August, the Bitcoin exchange rate against the US dollar updated its historical maximum at $124.5 thousand, but in a number of national currencies, including the euro, Swiss franc and Russian ruble, the record was never exceeded. In a pair to the ruble, the BTC price is still almost 20% below the peak – about 9.12 million rubles against 11.1 million rubles in December 2024.

The Bank of Russia included data on Bitcoin for the first time in the “Review of Financial Market Risks” for April 2025. Previous reports published on the Central Bank’s website did not include data on Bitcoin.

The Central Bank's sources for the assessment are data from the Moscow Exchange, Rosstat, Cbonds and Investing.com resources, as well as the Bank of Russia's own calculations. The yield of the instruments in the report is calculated based on the full actual ruble yield for the specified periods.

The report also provides some data on the digital financial assets (DFA) market. According to the regulator, since the beginning of the year, DFAs have become more accessible to non-qualified investors. In January, the share of such issues (excluding closed ones) was 66%, and in August – 96%.

Source: cryptonews.net