AI development and the US shutdown are not linked to Bitcoin's decline, analysts say.

The ongoing decline in the price of Bitcoin (BTC) has little to do with the prolonged US government shutdown or the “AI bubble,” analysts say.

Interactive Investor's Head of Investments Victoria Sholar said:

“Some investors have reduced their positions in speculative assets like Bitcoin for two reasons: fears about the impact of AI on digital assets and concerns about the crypto market being overly dependent on a small number of tech giants.”

On the topic: Experts have identified the main reasons for the Bitcoin price collapse.

On-chain analyst Rational Root has refuted the theory that the US shutdown will have a devastating impact:

“I wouldn't attribute Bitcoin's decline solely to the government shutdown,” he said.

The analyst believes that Bitcoin's pullback from its all-time high of $125,100 in October is more likely due to “excessive leverage in Bitcoin futures.”

PlanC also dismissed the idea that concerns about AI could influence Bitcoin's price.

“We can rule out the AI bubble thesis as a reason for Bitcoin's decline,” the analyst said.

What is the reason for the fall?

PlanC believes there are only a few possible reasons left: either the idea of Bitcoin's four-year cycle or delayed global liquidity.

“The four-year cycle narrative is highly likely to collapse,” he said.

Swan Bitcoin CEO Corey Klipsten told Cointelegraph that “there is a very high probability that Bitcoin's famous four-year price cycles have ended, destroyed by institutional adoption.”

On the topic: Glassnode has identified a resistance level for Bitcoin to exit correction mode.

Source: H.

Source: H.

Global liquidity, often tracked through the M2 monetary aggregate, also remains an important topic.

“Bitcoin is the most sensitive to liquidity. It reacts first. It's a truth machine,” said Strike CEO Jack Mallers.

The rollback was necessary

Rational Root stated that Bitcoin now has a “clean slate” and potential for further growth.

“In the last three years of this bull cycle, we've actually seen bear market-level sell-offs three times,” he said.

Moreover, each such reset subsequently led to the achievement of new highs, noted Rational Root.

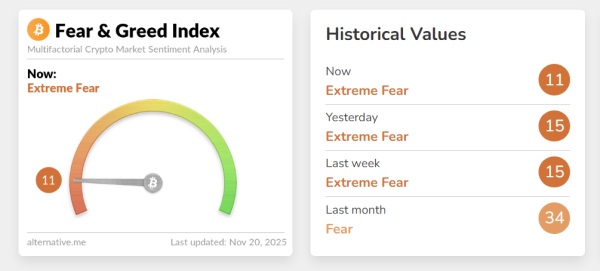

Source: alternative.me.

Source: alternative.me.

Investor sentiment has been in the “fear” zone for the past month. However, over the past week, it has dropped even lower, to February lows in the “extreme fear” zone.

On the topic: Arthur Hayes predicted Bitcoin could fall to $80,000–$85,000 due to signs of a credit crunch

Source: cryptonews.net