K33 Research: Bitcoin Investors 'Catching Falling Knives'

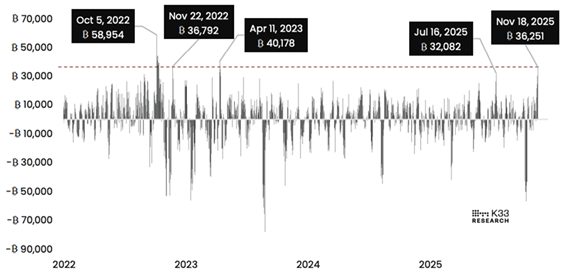

The market situation is causing concern, and Bitcoin investors and traders are “catching falling knives” as they try to predict the asset's future price movement, according to analysts at K33 Research.

The market situation is causing concern, and Bitcoin investors and traders are “catching falling knives” as they try to predict the asset's future price movement, according to analysts at K33 Research.

According to analysts, uncertainty in the Bitcoin market is compounded by rising funding rates. Traders and investors are overextending their limit orders, hoping that the leading cryptocurrency will soon rebound.

“Hopes for a rebound forced traders to leverage at the lows. Since the price hasn't risen, leverage now threatens the market with increased volatility due to forced liquidations,” commented Vetle Lunde , head of research at K33.

He emphasized that a sharp price movement in Bitcoin could result in a wave of liquidations affecting both buyers and sellers. However, rising funding rates indicate that the market is overflowing with long positions. If BTC prices suddenly fall, the massive exit of buyers will trigger an even more severe collapse.

K 33 Research noted a troubling gap: while some investors are actively speculating, institutional players are cautious and skeptical of the coin's growth. According to experts, in 86% of cases, this situation led to a price drop of an average of 16% in the following month.

Earlier, analysts from the on-chain platform CryptoQuant stated that a corrective scenario is dominating the Bitcoin market, in which the leading cryptocurrency could either fall to $87,500 or break through the $150,000 level.

Source: cryptonews.net