Key drivers of Bitcoin's October rally are now causing its price to fall.

According to NYDIG, the key factors driving Bitcoin's rise to its October peak are those now driving its price to multi-month lows, with reversals in crypto treasuries and outflows from crypto funds indicating “real capital outflows” rather than purely negative sentiment.

NYDIG Head of Research Greg Cipolaro said in a note on Friday that inflows into exchange-traded funds (ETFs) and demand for treasury digital assets (DATs) played a key role in Bitcoin's rise during the last cycle.

However, Cipolaro said the large liquidation that occurred in early October led to a reverse inflow of funds into ETFs, a drop in Treasury premiums, and a reduction in the supply of stablecoins, which is a signal of liquidity leaving the system and a “classic sign” that the cycle is “losing momentum.”

“Historically, once this loop is broken, the market tends to follow a predictable pattern. Liquidity contracts, leverage attempts to reform but struggles to gain momentum, and previously favorable announcements cease to translate into actual flows. We've seen this in every major cycle. The story changes, but the mechanics remain the same. The reflexive cycle pushes the market higher, and its reversal sets the stage for the next phase of the cycle,” Cipolaro stated.

Bitcoin's dominance is growing

Spot Bitcoin ETFs, which Cipolaro said have been the standout success story of this cycle, have gone from being a reliable driver of inflows “to a significant headwind,” but Bitcoin remains impacted by a broader set of factors, such as global liquidity shifts, macro headlines, market structure stress, and behavioral dynamics.

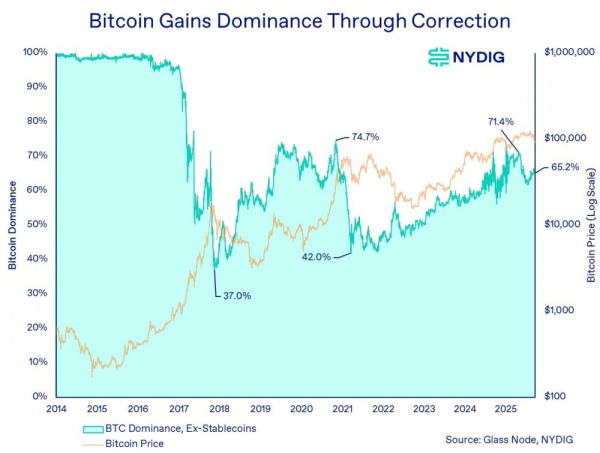

“Bitcoin's dominance typically rises sharply during cyclical downturns, as speculative assets are liquidated more aggressively and capital consolidates in the ecosystem's most established and liquid asset. We've seen this dynamic repeatedly, and we're seeing it again,” Cipolaro said.

Bitcoin's dominance tends to increase during downturns, as capital returns to the most reliable and liquid asset. Source: NYDIG.

According to crypto platform CoinMarketCap, Bitcoin's dominance once again exceeded 60% in early November and has since stabilized at around 58% as of Monday.

The Fall of DAT and Stablecoins

DAT and stablecoins were also a significant source of structural demand for Bitcoin. However, according to Cipolaro, DAT premiums (the price of shares traded relative to net asset value) have narrowed across the board, and stablecoin supply has decreased for the first time in months, as investors appear to be draining liquidity from the ecosystem.

Cipolaro said that even if the market decline intensifies, the DAT sector has a long way to go before real stress becomes a problem.

“It's important to note that while these changes mark a clear shift from a once-strong demand driver to a potential headwind, not a single DAT has yet shown signs of financial distress. Leverage remains moderate, interest obligations are manageable, and many DAT structures allow issuers to suspend dividend or coupon payments if necessary.”

Bitcoin's long-term trajectory remains unchanged

Despite the recent pullback, Cipolaro believes that Bitcoin's “secular story remains intact” as it continues to gain institutional support, sovereign interest is slowly growing, and its role as a neutral, programmable monetary asset remains vital.

“Nothing has changed this long-term trajectory in the last few weeks. But cyclicality, driven by flows, leverage, and reflexive behavior, is now asserting itself much more strongly,” he said. “Investors should hope for the best but prepare for the worst. If past cycles are any indication, the path forward will likely be bumpy, emotionally charged, and marked by sudden shocks.”

Source: cryptonews.net