Bitcoin will hold $80,000 – Arthur Hayes

BitMEX co-founder Arthur Hayes has updated his Bitcoin (BTC) forecast amid what he sees as slight positive shifts in global dollar liquidity.

In this regard, he has no doubt that the first cryptocurrency will hold the critically important level of $80,000.

In his statement, Hayes cited two key signs of improving dollar liquidity:

-

First, he believes the Fed's quantitative tightening (QT) will likely end on December 1, and that Wednesday will likely be the last dip in the Fed's balance sheet.

-

Second, US banks increased lending in November.

“We'll move below $90,000. There might be another hit below $80,000, but I think we'll hold above that,” he wrote.

Hayes added that he may begin “testing” to buy the asset, but will hold off on his “bazooka” – a major purchase – until the New Year.

On the topic: Strategy bought a record 8,178 BTC after daily purchases for a week.

Confirmation of previous forecasts

Hayes's new vision confirms his assessment from November 18. At that time, the expert predicted a drop in digital gold prices to the $80,000–$85,000 range due to “clear signs of an emerging credit crisis.”

At the same time, he allowed for the possibility of a simultaneous collapse of all markets. In such a scenario, he believed, Bitcoin could soar to $200,000 or even $250,000 if the US authorities “accelerate their machinations.”

The rate doesn't matter

During the latest discussion, Hayes was also asked about the impact of a possible Fed rate cut on the asset price. However, he categorically ruled this out.

“Who cares? Bitcoin rose from $16,000 to $100,000 when rates were much higher due to the decline in RRP (reverse repo),” the expert responded.

On the topic: Analysts have identified key factors for Bitcoin's recovery.

Hayes also stressed that the quantity of credit is more important than its price.

“We could reach an all-time high with the Fed rate at 10%, provided that the Fed simultaneously conducted unlimited QE,” he noted.

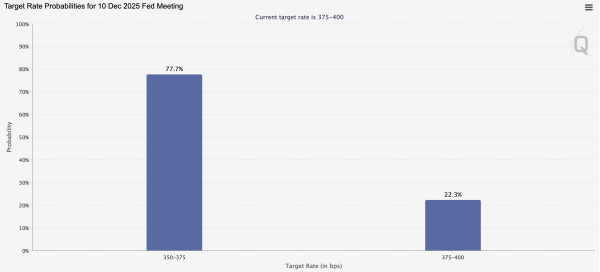

Meanwhile, the market itself is clearly keeping an eye on rates. The probability of a rate cut is currently estimated at $77.7%, according to CME Group's FedWatch. This is a significant jump, as just a week ago the rate was below 30%.

Probability of a Fed rate cut in December. Source: CME Group.

Probability of a Fed rate cut in December. Source: CME Group.

According to CryptoQuant analysts, if the agency decides not to lower the price, Bitcoin could remain stuck in the $60,000-$80,000 range. A new meeting is scheduled in just 16 days.

At the time of publication, the leading cryptocurrency is trading at $86,250, according to CoinMarketCap. Over the past week, the asset has lost 9%.

On the topic: CryptoQuant calls the probability of Bitcoin falling 70% from its ATH low

This article does not contain investment advice or recommendations. Every investment and trading decision involves risk, and readers should conduct their own research before making decisions.

Source: cryptonews.net