Harvard University nearly tripled its position in BlackRock ETFs.

Harvard University has nearly tripled its investment in a Bitcoin (BTC) spot ETF, The Block reports, citing a financial statement disclosing the asset structure of the world's largest academic endowment.

In the third quarter, Harvard reported owning 6,813,612 shares of IBIT, a stock held by financial giant BlackRock. This represents a 257% increase from the 1,906,000 shares it held at the end of June.

At the time, IBIT ranked fifth in the university's investment portfolio. Now, it's the largest holding, surpassing Microsoft, Amazon, and the SPDR Gold Trust, and has posted the most significant growth in a quarter.

It's unclear from the filings how much Harvard spent on stocks between the two reporting dates. The disclosed positions represent only a small portion of the university's endowment, which is valued at approximately $57 billion.

“This is perhaps the best signal of confidence an ETF could ever receive,” wrote Bloomberg analyst Eric Balchunas.

He noted that the university's half a billion investment represents only 1% of the total endowment. However, this amount is still sufficient to place it 16th among IBIT holders.

Harvard University's endowment structure. Source: Eric Balchunas's X account.

Harvard University's endowment structure. Source: Eric Balchunas's X account.

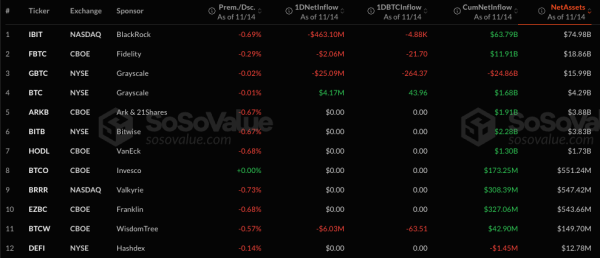

IBIT remains the largest spot Bitcoin ETF, with assets under management of approximately $75 billion.

Spot Bitcoin ETF ranking by assets under management. Source: SoSoValue.

Spot Bitcoin ETF ranking by assets under management. Source: SoSoValue.

Not just Harvard

Emory University, a private research university, has also increased its investments in Bitcoin ETFs, according to a recently filed report.

As of September 30, the institution holds more than 1 million shares of Grayscale's Bitcoin Mini Trust (ticker BTC), a bitcoin exchange-traded fund with $4.3 billion in assets under management. Its BTC holdings have grown 91% since June.

The organization also holds 4,450 shares of IBIT, unchanged from the previous report. The total position amounts to $42.9 million.

Emory University has become the first US university to disclose its investment in a spot Bitcoin ETF.

“There are risks involved in working with these instruments on your own,” said Matthew Lyle, an associate professor of accounting, commenting on the initial investment of more than $15 million in a Bitcoin ETF.

He noted that companies like Grayscale or BlackRock are unlikely to “simply take clients' money” because they are well-known players.

UAE sovereign wealth fund Al Warda Investments reported owning 7,963,393 shares of BlackRock's IBIT, valued at $517.6 million, as of September 30. This represents a roughly 230% increase from the 2,411,034 shares it reported in June, when the position first surfaced.

On the topic: Harvard economist admits he was wrong about Bitcoin's $100 crash forecast.

Source: cryptonews.net