Bitcoin Sets Record: Longest Growth Cycle in History

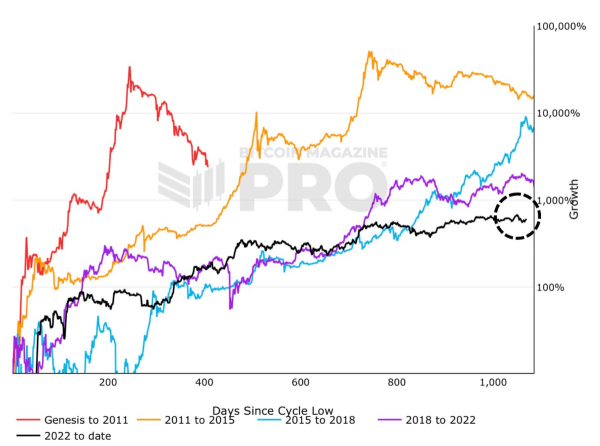

Bitcoin's current growth cycle has become the longest in the cryptocurrency's history. This result shows that the BTC market has entered a new stage of development: price movements have become more stable, and correction periods are gentler and longer.

We explain why growth has continued for so long, what processes are occurring within the market, and how the new structure is impacting investor strategies.

How to buy Bitcoin with a card: instructions

How Bitcoin's Growth Cycle Became Its Longest

The current period of growth has lasted longer than any previous one. Previously, Bitcoin would travel from trough to peak in about two and a half years, followed by a decline and a new bull run.

Comparing Bitcoin's growth cycles

Comparing Bitcoin's growth cycles

After a decline in 2022, the market has recovered and maintained positive momentum for several years now. The pace of growth has become more measured, without sharp spikes, and periods of weakness have become more extended. This dynamic indicates market maturation and a diminishing role for short-term speculation.

Investors have more time to accumulate, but the previous volatility, when prices would increase several times in a matter of months, has disappeared. Now, results depend not on luck, but on the ability to manage funds and control risks.

How the market rhythm has changed

In the early years of Bitcoin's existence, its rise was rapid. After a bottom, the price could rise tenfold, creating the illusion of an endless upward movement. Then a crash would follow, wiping out most of the gains.

Today, the market is developing differently. Growth is spread out over time, volatility has decreased, and corrections are gentle. Instead of wild swings, we're seeing a gradual strengthening, characteristic of more mature financial assets.

This change in rhythm has forced investors to rethink their behavior. While success previously depended on the timing of entry, now the ability to manage an asset throughout its growth cycle is more important.

Capital efficiency as a key factor

According to David Junior, CEO of Blocklords and founder of Nordbit, longer growth cycles require a new approach to investing:

“Longer cycles mean more time for accumulation, but require more efficient use of capital. A passive holding strategy becomes increasingly expensive as missed opportunities accumulate over time. This is why options strategies are especially important now.”

Sustained growth changes the very economics of asset ownership. When a cycle drags on for years, capital that sits idle loses its potential. The opportunity to increase returns arises through additional tools—options, hedging, staking, and liquidity management. Ignoring such tools leads to losses that become noticeable over time.

Why passive retention no longer produces the same results

Passive accumulation of Bitcoin remains a logical choice for those who see it as a store of value. However, in the face of prolonged growth, simply holding on no longer provides the best results.

A long cycle creates a new risk: loss of returns due to capital being idle. The longer the funds remain idle, the higher the cost of missed opportunities. For investors, this factor becomes as important as price fluctuations or commissions.

The modern Bitcoin market is closer to traditional financial systems. It's not just the price movement that matters, but also the ability to manage funds wisely. Those who take a flexible approach to capital management gain an advantage over those who simply wait for growth.

Market maturity and a new cycle structure

The duration of the current cycle shows that Bitcoin is gradually transforming from a speculative instrument into a part of the global financial system. Volatility is declining, the trading structure is becoming more stable, and the influence of institutional participants is growing.

Investment funds, exchange-traded products, derivatives trading platforms, and custodial services are active in the market. As a result, price fluctuations have become less sharp, and upward movements have become more even. Growth cycles still exist, but each now spans a longer period and proceeds more smoothly.

Conclusion

Bitcoin's growth cycle, which began after the 2022 crash, has become the longest on record. This development demonstrates the market's maturity and transition to a new type of dynamic.

Investors can no longer simply expect growth. Results depend on how efficiently capital is used and how funds are allocated throughout the cycle.

In an era of long market cycles, it's important not just to own an asset, but to be able to take advantage of the time the market offers. This approach reflects Bitcoin's transformation into a mature financial instrument, not just an object of speculation.

Source: cryptonews.net