Bitcoin has only two years to protect itself from quantum hacking.

Bitcoin could become the victim of a quantum hack in two years, according to Charles Edwards, founder of the investment company Capriole Investments.

He warned members of the crypto community about the approaching so-called “Q Day” – the moment when quantum computers will be able to crack BTC cryptography.

What is a quantum computer and how did it become a threat to cryptocurrencies?

The crypto community has little time left.

Edwards believes the community has just two years to agree on and implement a quantum solution to protect the Bitcoin network from possible hacking. According to him, consensus should be reached as early as 2026.

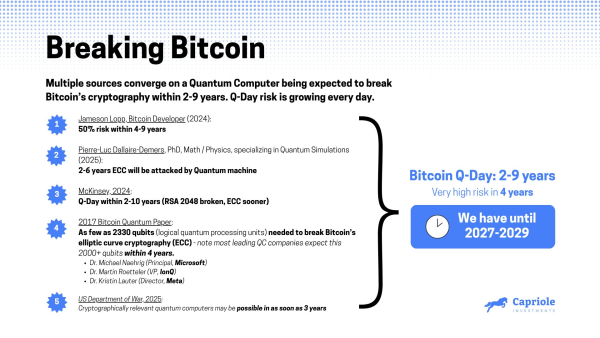

An infographic of the approaching quantum threat that Edwards accompanied his post

An infographic of the approaching quantum threat that Edwards accompanied his post

Edwards compiled forecasts from various sources that indicate the threat of quantum hacking could become real in as little as two to nine years, with the greatest risk occurring around 2027–2029.

Key assessments:

- Bitcoin developer Jameson Lopp (2024): 50% chance of quantum hack within 4-9 years.

- Physicist and mathematician Pierre-Luc Dallaire-Demers (2025): predicts that within 2–6 years, quantum computers will be able to attack the elliptic curve cryptography used in BTC.

- McKinsey (2024): expects Q-Day to occur in 2-10 years, with the RSA-2048 algorithm being cracked first, and elliptic curve cryptography even sooner.

- A 2017 paper by experts from Microsoft, IonQ, and Meta found that breaking Bitcoin's cryptography would require approximately 2,330 qubits, and leading quantum computing companies expect to achieve this power within four years.

- US Department of Defense (2025): Believes cryptographically significant quantum computers could be available within 3 years.

Edwards warns that if the crypto community fails to develop and implement a solution by 2026, there is a risk that future quantum machines could compromise the private keys and funds of BTC users.

Essentially, it calls for a global consensus within the network – similar to how Bitcoin previously went through the SegWit and Taproot upgrades.

Investors' Bitcoins Are Under Threat

Edwards has previously raised the issue of the quantum threat to cryptocurrencies. In mid-October 2025, he stated that quantum computers could destroy up to 30% of all existing Bitcoins. According to him, 20% to 30% of coins could be hacked by quantum machines within two to eight years, and this is impossible to prevent.

This primarily concerns old P2PK (pay-to-public-key) addresses used in the early days of the network. Such wallets lack protection against attacks that will become possible when quantum computers become capable of brute-forcing private keys. Among the vulnerable addresses, according to Edwards, could be wallets believed to belong to Satoshi Nakamoto, which hold approximately $125 billion in bitcoin.

He noted that the community faces a difficult choice:

- leave things as they are and allow quantum hackers to access old coins, which could cause a market crash worth hundreds of billions of dollars;

- or agree in advance on a migration period during which owners can transfer funds to quantum-protected addresses, after which all remaining assets must be destroyed.

Edwards believes that if around 30% of the supply were suddenly unlocked, it would undermine confidence in BTC as “hard money” and call into question the “trust the code” principle.

Some participants in the discussion proposed alternative solutions, such as limiting the withdrawal rate of old coins to avoid a sharp price decline. However, Edwards rejected this option, calling it “a compromise that doesn't solve the problem.”

Cryptocurrency experts have been warning for several years that the development of quantum technologies could threaten modern cryptographic algorithms. Most modern Bitcoin addresses use more secure schemes—such as P2PKH, P2WPKH, and P2TR—but early wallets created before 2010 remain a weak point in the network.

Source: cryptonews.net