Michael Saylor's Strategy Slowed Bitcoin Purchases in October to 778 BTC

Michael Saylor's Strategy, the world's largest public holder of Bitcoin, increased its BTC holdings last week amid growing momentum. However, buying activity has slowed significantly since September.

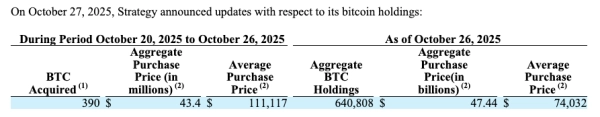

Strategy purchased 390 bitcoins worth $43.3 million in its most recent trade last week, according to a filing with the U.S. Securities and Exchange Commission on Monday.

The purchases were made at an average price of $111,117 per BTC. According to CoinGecko, Bitcoin briefly rose above $113,000 on Tuesday.

This purchase brings Strategy's total Bitcoin holdings to 640,808 BTC. They were acquired for approximately $47.4 billion, with an average price of $74,032 per coin.

Strategy posts one of the lowest monthly BTC purchases

Including the latest purchase of 390 BTC, Strategy accumulated 778 BTC in October. This is one of the smallest monthly results in its history.

Compared to the 3,526 BTC acquired in September, Strategy's October purchases were down 78%, highlighting the ongoing slowdown in accumulation. This latest purchase appears even more modest compared to massive acquisitions of 31,466 BTC and 26,695 BTC in July and May, respectively.

Excerpt from Strategy's Form 8-K. Source: SEC

According to CryptoQuant analyst J. A. Maartun, the sharp slowdown in Strategy's Bitcoin purchases is due to difficulties raising capital. The share premium fell from 208% to 4%.

“Strategy isn't buying much anymore – but they're still buying,” Maartun wrote in a post on X on Sunday.

He added that long-term confidence remains “even despite mounting funding pressures.”

Source: JA Maartun.

Despite the sharp slowdown, 2025 remains Strategy's largest year yet for Bitcoin investment. To date, $19.53 billion has been spent on BTC. According to Maartun, the company still has approximately two months to surpass last year's record of $21.76 billion spent on BTC.

Strategy's 390 BTC purchase last week came as its Class A shares, MSTR, fell below $280. This marked the beginning of a gradual selloff after the stock peaked near $456 in July, according to TradingView data.

Source: cryptonews.net