Bitcoin approaches $92,000 amid expectations of a Fed rate cut

- Bitcoin reached $91,942 at one point, after which it rolled back.

- The rest of the market also saw growth, albeit to a lesser extent.

- The upward trend is fueled by expectations of a Fed rate cut in December.

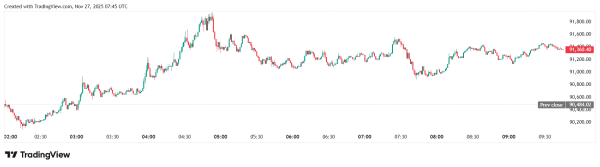

On the night of November 27, 2025, Bitcoin experienced positive momentum, reaching $91,942, according to TradingView. Experts believe the upward trend is fueled by expectations of an interest rate cut by the US Federal Reserve (Fed).

While preparing this material, it is clear that the asset has successfully consolidated above the $91,000 level.

BTC/USDT exchange rate on Binance. Source: TradingView.

BTC/USDT exchange rate on Binance. Source: TradingView.

Following the lead of the leading cryptocurrency, other major assets also showed positive dynamics. However, it's clear that altcoins are lagging behind, as their daily gains remain smaller. Ethereum stands out, with its price recovering to $3,000.

Top 10 crypto assets by market capitalization. Source: CryptoRank.

Top 10 crypto assets by market capitalization. Source: CryptoRank.

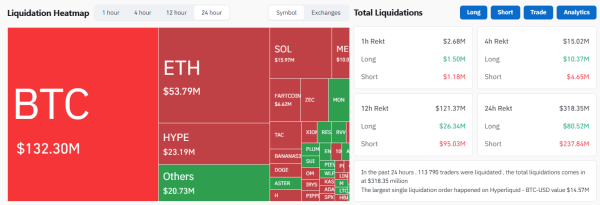

The sharp uptrend has impacted traders' short positions. The total daily liquidation volume on the futures market is over $318 million, with short positions dominating.

Daily liquidation volume for crypto asset futures contracts. Source: CoinGlass.

Daily liquidation volume for crypto asset futures contracts. Source: CoinGlass.

The Fear and Greed Index remains deep in the red. However, this indicator also shows a positive trend, rising three points over the past 24 hours.

Cryptocurrency Market Fear and Greed Index. Source: CoinStats.

Cryptocurrency Market Fear and Greed Index. Source: CoinStats.

Vincent Liu, CIO of Kronos Research, told The Block that the uptrend is fueled by two factors: oversold assets and positive expectations for the Fed's rate decision in December 2025.

“Bitcoin's rise above $90,000 reflects a classic oversold spike. After a sharp decline, buyers are entering the market. The general appetite for risk, fueled by an 80% chance of a Fed rate cut in December, is giving markets the necessary impetus to stabilize and regain momentum,” the expert noted.

The Fed cut interest rates at the end of October 2025, but Chairman Jerome Powell made it clear that further policy easing was not guaranteed.

However, amid rumors that President Donald Trump has already chosen a candidate for the job, expectations for a rate cut have grown. According to the CME forecast, the probability of such a scenario is estimated at 84.9%. A week ago, it was around 40%.

Source: cryptonews.net