Analysts have recorded a record volume of “awakened” Bitcoins.

The volume of digital gold moved since the beginning of the year, after being inactive for over seven years, has reached a new all-time high. This was noted by analysts at OnChainSchool.

In 2023, the figure was 59,000 BTC, in 2024 – 255,000; in less than 2025 – 270,000.

“More and more coins from the early era are starting to move,” the researchers emphasized.

They named possible reasons for what is happening:

- old miners are moving long-term reserves;

- funds are transferred to new cold wallets for security reasons;

- Long-term holders are selling some of their coins amid high prices.

“If the trend continues, the volume of coins moved will exceed 300,000 BTC in 2025,” the analysts predicted.

Hodlers are putting pressure on the price

On-chain expert Darkfost identified the factor that worries him most about the current market situation:

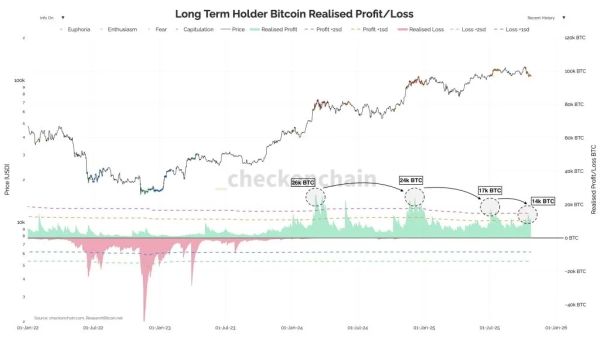

“After peaking at 14,000 BTC in realized profits, long-term holders are still locking in around 12,000 BTC today, which remains at a high level.”

However, the analyst noted that the figure has been gradually declining as the cycle progresses. At the first local peak, it was 26,000 BTC, then dropped to 24,000 BTC, and recently dropped to 17,000 BTC.

Profit dynamics realized by long-term Bitcoin holders. Source: Darkfost.

Profit dynamics realized by long-term Bitcoin holders. Source: Darkfost.

In the context of short-term prospects, the expert allowed for two possible scenarios:

- strong demand that could absorb current sales;

- a deeper correction that could “neutralize the remaining selling pressure.”

In conclusion, Darkfost urged to closely monitor this metric.

In turn, analyst Axel Adler Jr. noted a decrease in “speculative pressure”:

“In a bull market, such values coincide with periods of accumulation of positions before a new phase of growth.”

Bitcoin Heat Macro Phase has dropped into the Bottom / Accumulation zone, indicating a decrease in speculative pressure. In a bull market, such values coincide with periods of position accumulation before the next growth phase. To realize a rally, volatility needs to decrease and… pic.twitter.com/bdVMsI7RCA

— Axel 💎🙌 Adler Jr (@AxelAdlerJr) October 24, 2025

To trigger a rally, a decline in volatility and “an absence of negative factors in the world for at least a week” are needed, the expert added.

As a reminder, whales recently sold 17,500 BTC amid a market decline.

Trader: Bitcoin price will exceed $125,000 after another drop

Source: cryptonews.net