Analysts have identified conditions for Bitcoin to rise to $200,000.

If the current rate of demand growth continues, the first cryptocurrency could reach $160,000-200,000 by the end of the year, according to CryptoQuant analysts.

If the current rate of demand growth continues, the first cryptocurrency could reach $160,000-200,000 by the end of the year, according to CryptoQuant analysts.

Bitcoin has crossed $117K, reclaiming the Trader's Realized Price ($116K).

This shift puts BTC back in the BULL phase of the cycle indicator.

From here, Q4 targets expand $160K–$200K. pic.twitter.com/FlYePG6kL9

— CryptoQuant.com (@cryptoquant_com) October 1, 2025

According to their data, spot Bitcoin purchases have been increasing by 62,000 BTC per month since July. This is comparable to the dynamics before previous rallies in the fourth quarters of 2020, 2021, and 2024.

Experts also noted increased demand from whales and exchange-traded funds. Large holders are increasing their exposure at a rate of 331,000 BTC per year, significantly exceeding similar periods in previous years:

- 238,000 BTC in the fourth quarter of 2020;

- 197,000 BTC — 2021;

- 255,000 BTC – 2024.

Over the same period last year, US ETFs acquired 213,000 BTC—71% more than the previous quarter. The current situation suggests a repeat of this trend over the next three months.

Price guideline

According to analysts, Bitcoin successfully surpassed the $116,000 realized price level and officially entered the bullish phase of the cycle. After testing this mark and consolidating around $117,300, experts set a quarterly target range of $160,000-$200,000.

They emphasized that this optimistic scenario is supported by technical indicators. The CryptoQuant Bullish Strength Index was in the 40-50 range at the end of the third quarter. The same trend was observed last year, when the leading cryptocurrency's price rose from $70,000 to $100,000.

“These index values mark the transition to a bullish phase of the market cycle,” the experts explained.

Three key factors are providing support: sustained growth in demand for Bitcoin, increased stablecoin liquidity, and a decline in traders' unrealized profits. All of these factors “combine to reduce the potential for selling.”

CryptoQuant contributor Crypto Dan also noted that the digital gold bull run is continuing. He added that there are no clear signs yet that it's ending.

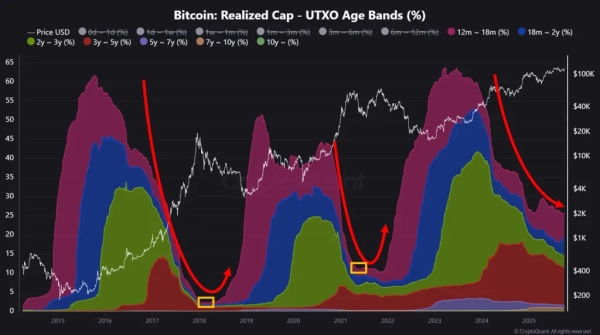

He pointed to the actions of long-term Bitcoin holders. When the growth cycle approaches its peak, this group of investors begins actively selling the asset—especially coins held for more than a year. Now, a different picture is being observed: the share of “older” coins is gradually declining, hinting at a new growth momentum.

Source: CryptoQuant.

Source: CryptoQuant.

As a reminder, experts have identified several key indicators signaling a potential “major move” in Bitcoin.

XWIN Research analysts also explained the pattern of seasonal rallies in the fourth quarter.

Source: cryptonews.net