A Bitcoin whale closed a $392 million short, which traders saw as a signal of a trend reversal.

Bitcoin whale “0xb317” has completely closed a short position worth 3,440 BTC (~$390 million) with a liquidation of $128,030. The day before, he reopened a short position after taking a profit, at which point the position reached 3,000 BTC (~$340 million), according to Lookonchain.

Last week, “0xb317” became one of the most talked about figures in the market when he shorted Bitcoin (BTC) half an hour before the market's sharp drop, earning an estimated $190 million in profit.

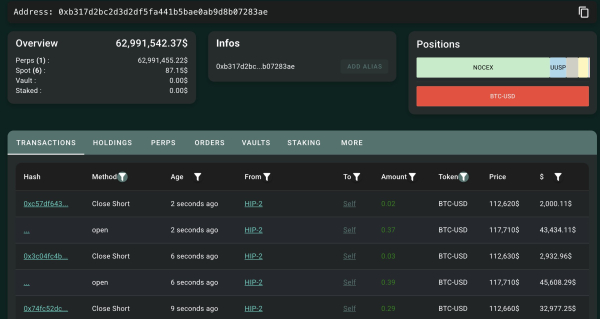

Whale “0xb317” closing his position. Source: Lookonchain.

Whale “0xb317” closing his position. Source: Lookonchain.

The trader has now completely closed his positions, which market participants interpret as a possible signal that the downward movement is ending.

“Is he expecting a rebound?” speculated an investor nicknamed Ted.

According to CoinMarketCap, Bitcoin is trading at $113,167 at press time. Over the past week, the asset has lost 6.3%.

Related: Hackers drain $20 million from Hyperliquid trader's account

Signal to turn around?

Some users confirmed that the closing of large shorts often coincides with a market reversal.

“When whales cover shorts, it usually means that the short-term decline is over and the market is preparing for a reversal,” said a BAARUT analyst.

Other participants urged caution against jumping to conclusions. Trader Kiryl noted that it's important to analyze not only the moment of position closing but also the overall strategy.

“It's important to look not only at profits but also at the structure of positions to understand the overall picture of market movements,” he said.

Previously, “0xb317” earned a reputation as an “insider whale.” His trades often coincided with major announcements and market trends.

Some users have speculated that his activity triggered the recent wave of leveraged long liquidations that crashed the market over the weekend.

Despite the position closing, analysts note that the actions of such players remain an important indicator of sentiment, especially during periods of high volatility.

On the topic: Are $19 billion in liquidations a consequence of a “controlled decline in leverage” or not? — opinion

Source: cryptonews.net