DOGE Price News: Surges 5% Amid Trump-Affiliated Dogecoin Mining Deal and Fed Comments

DOGE Climbs 5% Following Trump-Linked Mining Agreement and Fed Remarks

A $50 million acquisition of a Dogecoin mining company tied to Trump, Wyoming’s introduction of a government-supported stablecoin, and Federal Reserve indications of a more lenient approach toward digital assets combined to spark renewed institutional interest.

By Shaurya Malwa, CD AnalyticsUpdated Aug 22, 2025, 5:17 a.m. Published Aug 22, 2025, 5:17 a.m.

What to know:

- Dogecoin spiked following a Trump-associated $50 million mining firm purchase and Wyoming’s release of a state-endorsed stablecoin.

- Federal Reserve representatives hinted at a more accommodating stance on crypto, driving heightened institutional engagement.

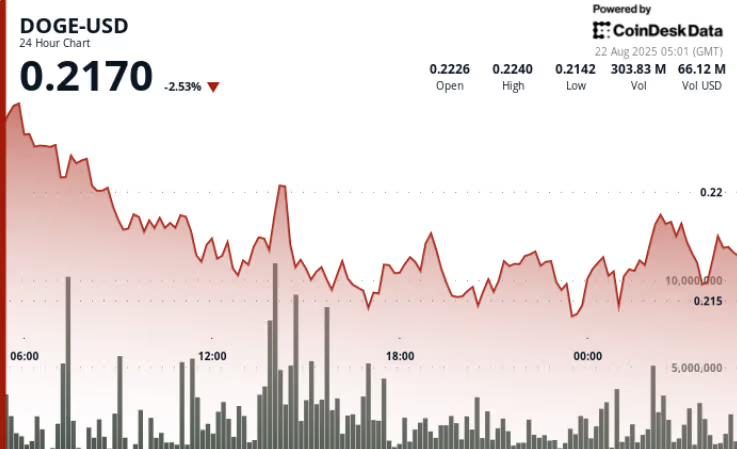

- DOGE oscillated between $0.21 and $0.22, with heavy trading activity pointing to robust institutional involvement.

Dogecoin soared on Tuesday as regulatory developments and corporate moves altered market sentiment. A Trump-connected $50 million mining acquisition, Wyoming’s state-backed stablecoin debut, and Federal Reserve remarks favoring digital assets ignited a wave of institutional investment.

News Background

• Thumzup, a Trump-aligned firm, purchased Dogehash for $50 million, forming what executives touted as the biggest Dogecoin mining network. The agreement demonstrates substantial investor faith in DOGE’s infrastructure.

• Wyoming launched the Frontier Stable Token, the inaugural government-backed stablecoin, highlighting the U.S. regulatory shift toward embracing digital currencies.

• Fed Vice Chair Michelle Bowman cautioned banks about competitive threats if they delay crypto adoption, reflecting a friendlier regulatory outlook.

• SoFi Technologies incorporated Bitcoin’s Lightning Network, aiming to tap into the $740 billion remittance sector — a further sign of traditional finance embracing crypto frameworks.

Price Action Summary

• DOGE moved within a narrow $0.01 range ($0.21–$0.22) from Aug. 20 15:00 to Aug. 21 14:00, indicating approximately 4–5% daily price swings.

• The token jumped 5% from $0.21 to $0.22 during evening trading on Aug. 20, setting $0.22 as immediate resistance.

• A late-hour surge (Aug. 21 13:22–14:21) saw DOGE climb 1% from $0.22 to $0.22, accompanied by volume spikes exceeding 61.8 million, highlighting institutional participation.

• Support remained firm between $0.21 and $0.22, with rebounds on 320–380 million trades during critical tests.

Technical Analysis

• Support: $0.21–$0.22 confirmed as a solid foundation through repeated high-volume tests.

• Resistance: The $0.22 critical threshold was breached, but sustained momentum toward $0.225 is needed to validate the upward move.

• Volume: Spikes of 61.8 million and 378.6 million underscore strong institutional demand.

• Pattern: Consolidation followed by a sharp upward breakout; bullish momentum depends on maintaining current support levels.

• Futures OI: Hovering near $3 billion shows consistent leveraged positions despite broader market fluctuations.

What Traders Are Watching

• Whether DOGE can maintain momentum above $0.22 and advance toward the $0.225–$0.23 barrier.

• Market response to Federal Reserve policy adjustments and Wyoming’s stablecoin initiative — a potential industry-wide boost.

• Whale accumulation trends, already reaching 2 billion DOGE ($500M) this week.

• Mining sector growth via Thumzup’s acquisition and its influence on DOGE’s mining power allocation.