Bitcoin rises slightly after US CPI data release

Bitcoin prices edged up slightly on Thursday after new U.S. inflation data was released, with markets looking for clues about Federal Reserve policy.

Bitcoin, which often reacts to consumer price index (CPI) data due to its impact on interest rates and the dollar, briefly rose to $114,034 after the report was released.

Annual inflation reached 2.9% in August, US CPI data show

The U.S. consumer price index (CPI) rose 2.9% year-over-year in August, in line with expectations, according to the Labor Department. That follows a 2.7% CPI reading in July. The CPI measures retail inflation and is an important economic indicator.

Meanwhile, the producer price index (PPI), which tracks wholesale inflation, unexpectedly fell in August, weighed down by weaker trade services margins and modest increases in the cost of goods. The reading came in below expectations at 2.6% year-on-year, well below the 3.3% forecast. The weaker PPI data bolstered expectations of a Fed rate cut and increased risk appetite in stock and crypto markets.

“With labor market data recently revised down significantly and signs of an economic slowdown emerging, this inflation report will be the last key data point before the Federal Reserve’s September meeting and will have a major impact on the pace of future rate cuts,” Bitunix analysts told BeInCrypto ahead of the CPI data release.

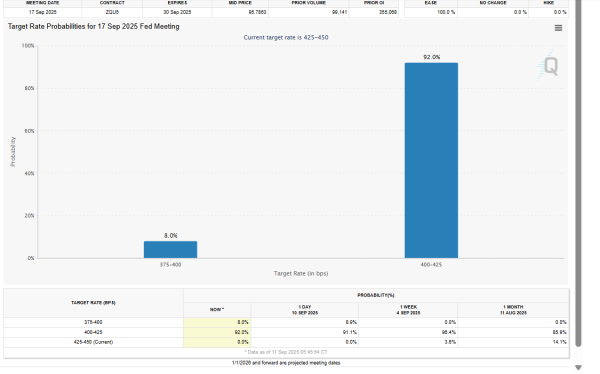

The Fed is likely to cut interest rates by 25 basis points at its meeting next Wednesday. Investors are also eyeing a small chance of a 50 basis point cut, according to CME FedWatch.

Fed Rate Cut Probabilities Source: CME FedWatchTool

Fed Rate Cut Probabilities Source: CME FedWatchTool

In the cryptocurrency market, analysts at Bitunix noted that Bitcoin is experiencing strong liquidation pressure around $114,000, which is creating a major resistance zone.

“If CPI data is soft and pushes BTC above this level, it could trigger a short squeeze and accelerate the move into the liquidity zone above $115,000,” they noted. “If inflation beats expectations and strengthens the US Dollar Index (DXY), delaying rate cut expectations, $111,000 would be the first key support, with a possible retest of the $108,500-$109,000 liquidity zone if it is broken.”

They advise traders to reduce positions before the CPI data is released. Although the Producer Price Index (PPI) unexpectedly fell, the CPI can still push prices higher. Traders should keep an eye on Bitcoin resistance at $114,000 and support at $111,000 to navigate possible market swings.

Inflation complicates the short-term outlook for Bitcoin. If CPI data is higher than expected, it usually puts pressure on risk assets like BTC and could lead to monetary tightening and a stronger US dollar. Conversely, lower inflation could support crypto markets, increasing the chances of a rate cut next week.

Source: cryptonews.net