A well-known analyst explained why Bitcoin (BTC) may grow in the near future

Bitcoin prices are on the rise again. They fell to $108,600 on Tuesday but quickly recovered above $112,000. A brief surge in selling caused a surge in inflows to exchanges, but they are now falling again

Crypto analyst CryptoOnchain believes the decline has stopped and further declines are unlikely, citing data from CryptoQuant on Wednesday.

Selling pressure in the Bitcoin market is easing

The analyst explained that the 30-day moving average for Bitcoin inflows has been declining after hitting its lowest level since May 2023. The indicator bottomed in July but soon rose as Bitcoin hit a new all-time high. The rise was driven by profit-taking by investors.

BTC: Realized Price by Age. Source: Trading View

BTC: Realized Price by Age. Source: Trading View

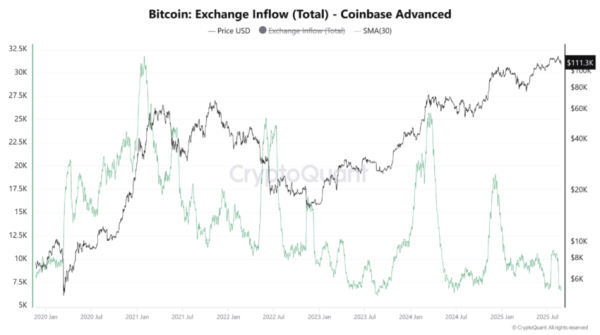

Inflows into exchanges peaked in April when new US tariff policies were announced. At the time of writing, they have fallen to record lows during the latest price decline. CryptoOnchain noted that the decline is significant. It calculated the decline across all exchanges and attributed it to a price recovery. Bitcoin has risen to $111,000.

US Investors Stop Selling

These investors have been the driving force behind the recent rally, and a similar situation is being seen on the Binance spot market. CryptoOnchain sees this as a bullish signal. The supply of Bitcoin available for sale is decreasing, which could strengthen market sentiment. The analyst predicts medium-term growth for BTC.

Bitcoin: Exchange Inflows (Total) VS Coinbase Advanced. Source: CryptoQuant

Bitcoin: Exchange Inflows (Total) VS Coinbase Advanced. Source: CryptoQuant

Coinbase Advanced shows a sharper decline, indicating low selling pressure. The data supports CryptoOnchain's view that investors may be holding assets in anticipation of higher prices. This reduces the number of coins available for sale, creating upward pressure on prices.

Source: cryptonews.net