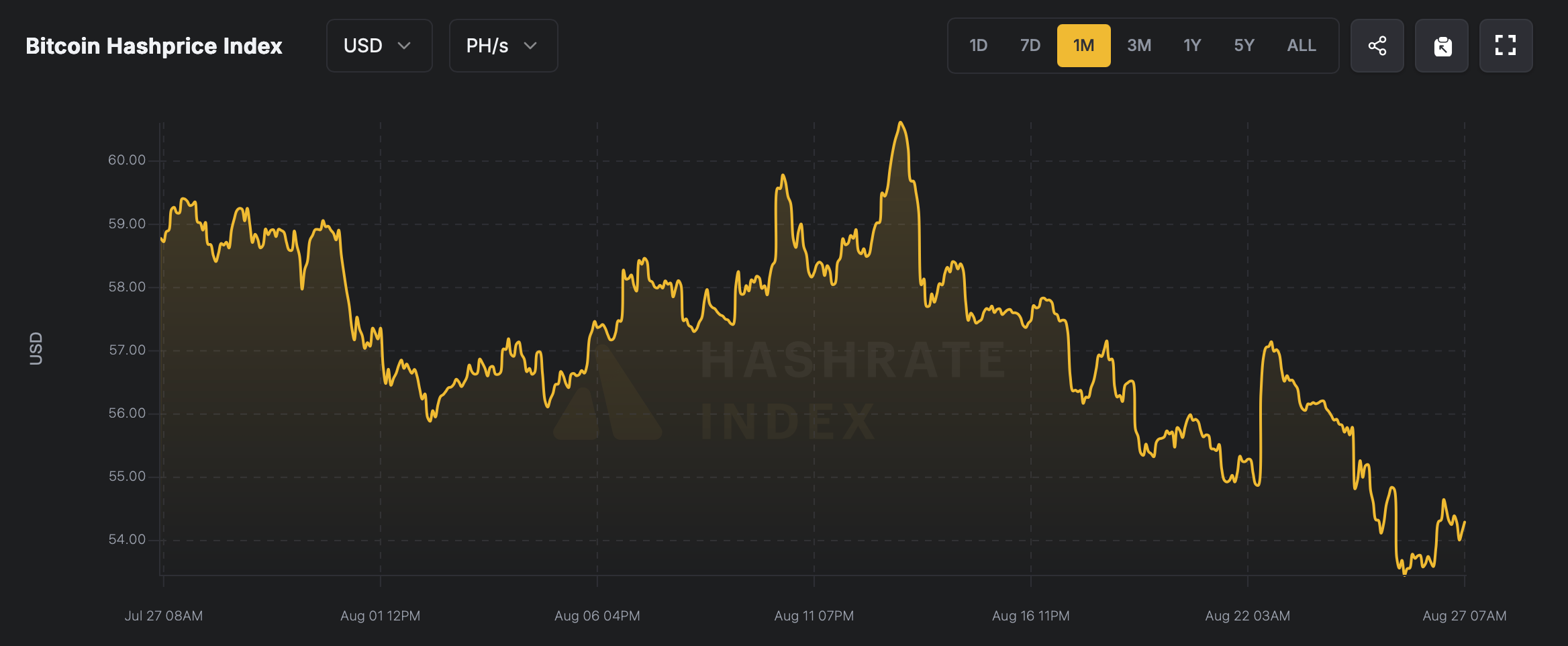

Bitcoin Mining Earnings Dip as Hashprice Falls 7.61% in 30 Days

Recent figures indicate a downward trend in Bitcoin mining revenues, characterized by periods of heightened volatility. The hashprice—the estimated daily earnings for 1 petahash per second (PH/s) of computational capacity—has dropped 7.61% since July 27.

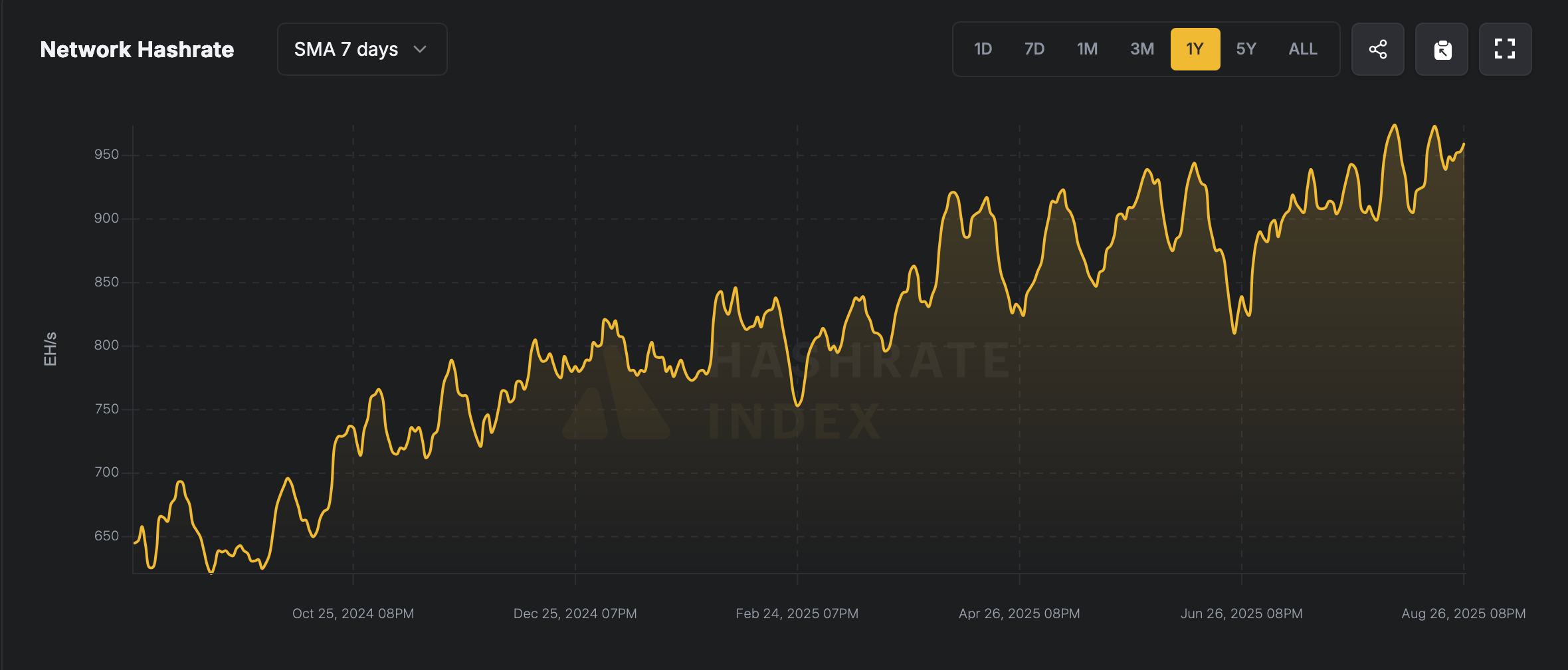

Network Hashrate Holds Steady Amid Faster Block Times Preceding Expected Difficulty Adjustment on Sept. 5

Bitcoin’s mining difficulty currently stands at 129.7 trillion, following a modest 0.20% rise five days ago at block height 911232. While this uptick has tempered miners’ ability to swiftly discover blocks amid falling income, the network’s computational power persists near historic levels, registering 965.77 exahash per second (EH/s) as of Aug. 27—merely 11 EH/s below its all-time high.

Source: hashrateindex.com

Source: hashrateindex.com

With mining activity maintaining consistency, block processing has accelerated. As of Wednesday morning Eastern Time, average block intervals hover around nine minutes and 37 seconds. Approximately 1,300 blocks remain until the next difficulty recalibration, anticipated around Sept. 5, 2025, currently forecasted to rise by +3.93%. However, this projection remains subject to significant fluctuation.

Source: hashrateindex.com

Source: hashrateindex.com

Current daily revenue for 1 PH/s of mining power is $54.30, reflecting a 7.61% monthly decrease from $58.77 per PH/s recorded 30 days prior. Despite this downturn, present values stay marginally above the recent trough of $53.44.

This trend underscores how miners’ persistence influences Bitcoin’s ecosystem, counterbalancing profit challenges with sustained computational input—likely driven by advanced hardware. Moving forward, the relationship between operational expenses, block rewards, and network power will continue to play a pivotal role in shaping the blockchain’s durability and expansion.

Source: cryptonews.net