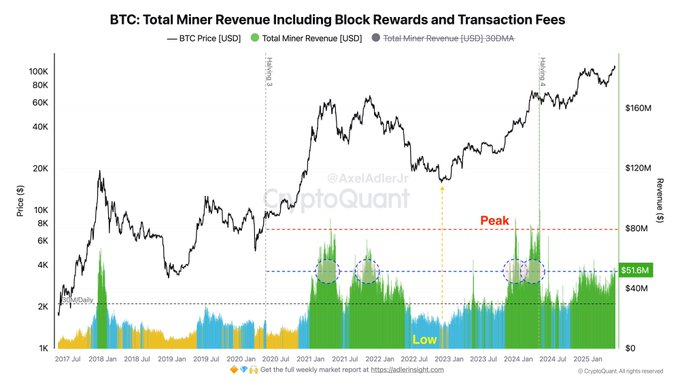

Bitcoin Miner Revenue Rises to $51.6 Million a Day, Still Below Record Highs

The Bitcoin market continues to show stability, with miner revenues increasing and exchange inflows indicating increased network activity. However, these key metrics have yet to reach the levels seen at the peaks of previous cycles. According to the latest data provided by a market analyst, Bitcoin miners are currently earning approximately $51.6 million per day.

After the ATH, miners began to sell their funds on exchanges more actively. The inflow doubled from an average of 25BTC to 50BTC per day, while historical maximums reach around 100BTC.

This shows that sales have indeed accelerated, although we are still far from peak volumes and… pic.twitter.com/fTsGLyKovc

— Axel 💎🙌 Adler Jr. (@AxelAdlerJr) May 27, 2025

While this figure is impressive, it remains below the historical peak of over $80 million per day in revenue that was recorded during previous market highs. This indicates that despite the high network activity, there is potential for mining revenue to increase further before it reaches its historical highs.

Exchange inflows from miners double, but market successfully absorbs supply; activity below peak levels

Another significant trend is the increase in miner inflows to exchanges. After Bitcoin recently reached a new all-time high, miners have stepped up their selling activity. The average daily inflow has doubled from about 25 BTC per day to 50 BTC per day. Historically, the maximum levels of miner inflows to exchanges have reached about 100 BTC per day.

Source: Axel/X

Source: Axel/X

Despite this increase in supply, the market has shown great absorption capacity, successfully handling the additional bitcoins miners are selling. This robust demand indicates that while selling pressure has increased, it has not yet flooded the market.

Both rising miner revenues and increased exchange inflows indicate a healthy and active Bitcoin network. Current metrics leave room for further growth. As long as revenues and inflows remain below historical highs, this implies that the market has additional room to expand in the current cycle.

Has Bitcoin Peaked? What's Next?

Analysts estimate that the next Bitcoin price peak is expected to be in the range of $200,000 to $250,000. After reaching these levels, a correction is possible. For example, if Bitcoin reaches $200,000 and then falls by 50%, the price will settle at around $100,000 — which seems likely based on previous market behavior.

Source: CoinMarketCap

Source: CoinMarketCap

If large hedge funds and Wall Street investors start to view Bitcoin as a credible alternative to traditional fiat currencies, especially in times of economic hardship, demand could increase. In that case, Bitcoin could not only reach $200,000 to $250,000, but also exceed those levels.

Disclaimer: The information provided in this article is for informational and educational purposes only. The material does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of using the content, products or services mentioned. Readers are advised to exercise caution before taking any action related to this topic.

Source: cryptonews.net