Chart of the Week: Tariff Carnage Begins to Fulfil BTC's 'Store of Value' Promise

Chart of the Week: Tariff Carnage Begins to Deliver on Bitcoin's 'Store of Value' Promise

Bitcoin has become a new safe haven asset for investors alongside traditional assets such as gold and the Swiss franc.

Author: Aoyon Ashraf | Edited by: Francisco Rodriguez April 27, 2025, 2:00 PM

What you should know:

- April has been an extremely volatile month in the market due to President Trump's tariff announcements.

- Bitcoin, along with traditional safe-haven assets such as gold and the Swiss franc, is becoming the choice of investors.

- Amid growing market uncertainty, Bitcoin is gaining acceptance as a non-sovereign store of value.

April was a month of significant volatility and a turbulent period for traders.

From President Donald Trump's mixed news on tariffs to the overall confusion over finding safe assets, it's been a month for history.

In this chaos, where traditional “safe haven” assets have failed to provide a reliable place to store capital, one unexpected player has emerged that may have surprised some market participants: Bitcoin.

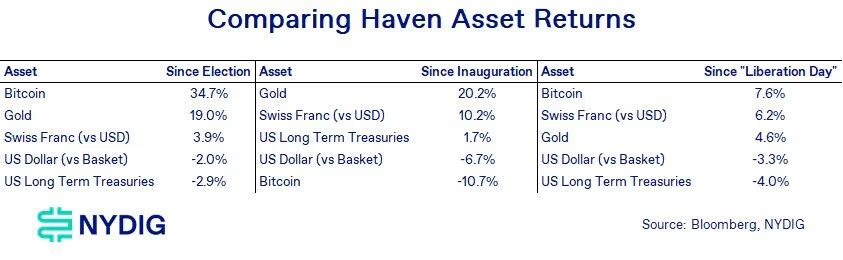

“Historically, cash (US dollars), bonds (US Treasuries), the Swiss franc and gold have filled this [safe haven] role, and Bitcoin is slowly taking over some of that space,” NYDIG Research says.

Data from NYDIG showed that while gold and the Swiss franc remain strong safe-haven assets, Bitcoin has joined the ranks following “Liberation Day,” when President Trump announced a significant increase in tariffs on April 2.

“Bitcoin does not behave like a liquid credit version of U.S. stocks, but rather like the non-sovereign store of value that it is,” NYDIG notes.

Current events aside, it seems that as the “sell America” trade grows, investors are increasingly turning their attention to Bitcoin and its initial promise to become a leading cryptocurrency.

“While the connection is still tentative, Bitcoin appears to be fulfilling its original promise as a non-sovereign store of value that should thrive in times like these,” NYDIG added.

Read more: Safe-haven appeal of gold and bonds may wane with Bitcoin