Bitcoin fell below $108,000

Cryptocurrencies and crypto-related stocks opened lower on Thursday as the Federal Reserve's unexpectedly hawkish stance on Wednesday outweighed significant progress on trade with China.

Presidents Trump and Xi Jinping met yesterday evening, and Treasury Secretary Scott Bessent announced Thursday morning that the US government was suspending plans to expand the blacklist of Chinese companies. He also announced an agreement under which China will significantly increase its purchases of American soybeans this year and in the future.

While headlines like these might have previously boosted traditional and cryptocurrency markets, it now appears the good news has already been priced in.

Instead, Federal Reserve Chairman Jerome Powell's statement yesterday that further rate cuts were far from guaranteed continued to weigh on markets, with bond yields and the dollar continuing to strengthen.

Bitcoin (BTC) hit a new low on Wednesday at $111,502.81, falling below $108,000 and reaching its lowest price in more than a week. It has lost 4.4% over the past 24 hours and is nearly 8% lower than Monday's high of $116,000.

Ethereum (ETH) fell 5%, falling below $3,800 at ETH ($3,944.51). Major altcoins XRP ($2,4758), Solana ($187.60), DOGE ($0.1825), and ADA ($0.6467) all lost 5-7% of their value on the day.

Cryptocurrency-related stocks mirrored the broader market decline. Coinbase (COIN), which reports third-quarter earnings after the market closes, fell nearly 3%. Strategy (MSTR), Robinhood (HOOD), and Circle (CRCL) fell 2%, while Gemini (GEMI) suffered the most, falling nearly 5%. Mining stocks also traded lower.

The Nasdaq is also experiencing a busy earnings season: Meta shares fell 12% on disappointing results, while Google shares rose 5% after disappointing results. The S&P 500 index fell slightly, while the DJIA rose during the session.

October disappoints the bulls

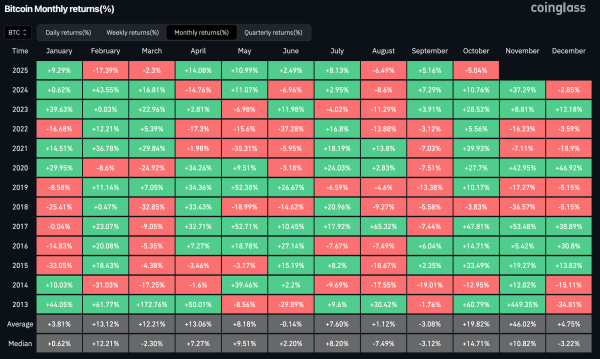

October is drawing to a close, and crypto traders' hopes for a bull market, often referred to as “Uptober,” are almost certainly dashed. At current prices, Bitcoin has fallen more than 5% in the month, marking its worst October performance since 2014.

Bitcoin Monthly Return (CoinGlass)

Bitcoin Monthly Return (CoinGlass)

Amid a cryptocurrency market correction, the frenzy surrounding treasury digital assets (TDAs) that swept Wall Street earlier this year, when public companies began buying cryptocurrency by selling stocks and debt, has begun to fade. Many once-highly liquid stocks have fallen below their underlying net asset value.

Strategy (MSTR) shares have hit a new low following the April tariff hysteria and are currently trading at $268, down 50% from their all-time high reached in November 2024, including a staggering 40% drop since mid-July. The company will report third-quarter earnings after the close of trading today. MSTR shares are currently trading at a premium of 1.33 times net asset value (mNAV), their lowest since February 2024.

KindlyMD (NAKA), another BTC-pegged cryptocurrency, has fallen 6% and is trading just below $0.90. It is at risk of being delisted from the Nasdaq. Meanwhile, Strive (ASST) is trading below its warrant price of $1.35 and is trading at $1.30, creating obvious short-term headwinds for further growth.

On Thursday, another player entered the DAT game: SEGG Media Corporation (SEGG), announcing a $300 million digital asset strategy aimed at “creating sustainable online revenue, accelerating tokenization in sports and entertainment, and bringing blockchain infrastructure to the global media ecosystem.” Just a few months ago, the headline alone would have sent the nanocompany's stock soaring, but the DAT bubble has since burst, with shares down 3% on Thursday.

Source: cryptonews.net