Why DeFi Projects Could Exceed Expectations: Kaiko Research

Clarity in regulation could spur the development of DeFi projects.

Updated Feb 28, 2025 7:32 pm UTC Published Feb 28, 2025 6:31 pm UTC

Key points:

- DeFi protocols could outperform forecasts in the second half of 2025, according to Kaiko Research.

- The Trump administration may provide long-awaited clarity on how these projects are regulated.

- Kaiko highlighted the potential of individual tokens such as UNI, ONDO and AAVE.

Bitcoin (BTC) has taken center stage in 2024 compared to the rest of the crypto market, but the Trump administration is quickly changing the rules of the game, which could lead to a shift to other assets, according to crypto data firm Kaiko Research.

In fact, the decentralized finance (DeFi) sector looks quite promising, as Kaiko analysts Adam McCarthy and Dessislava Obert note in a new report.

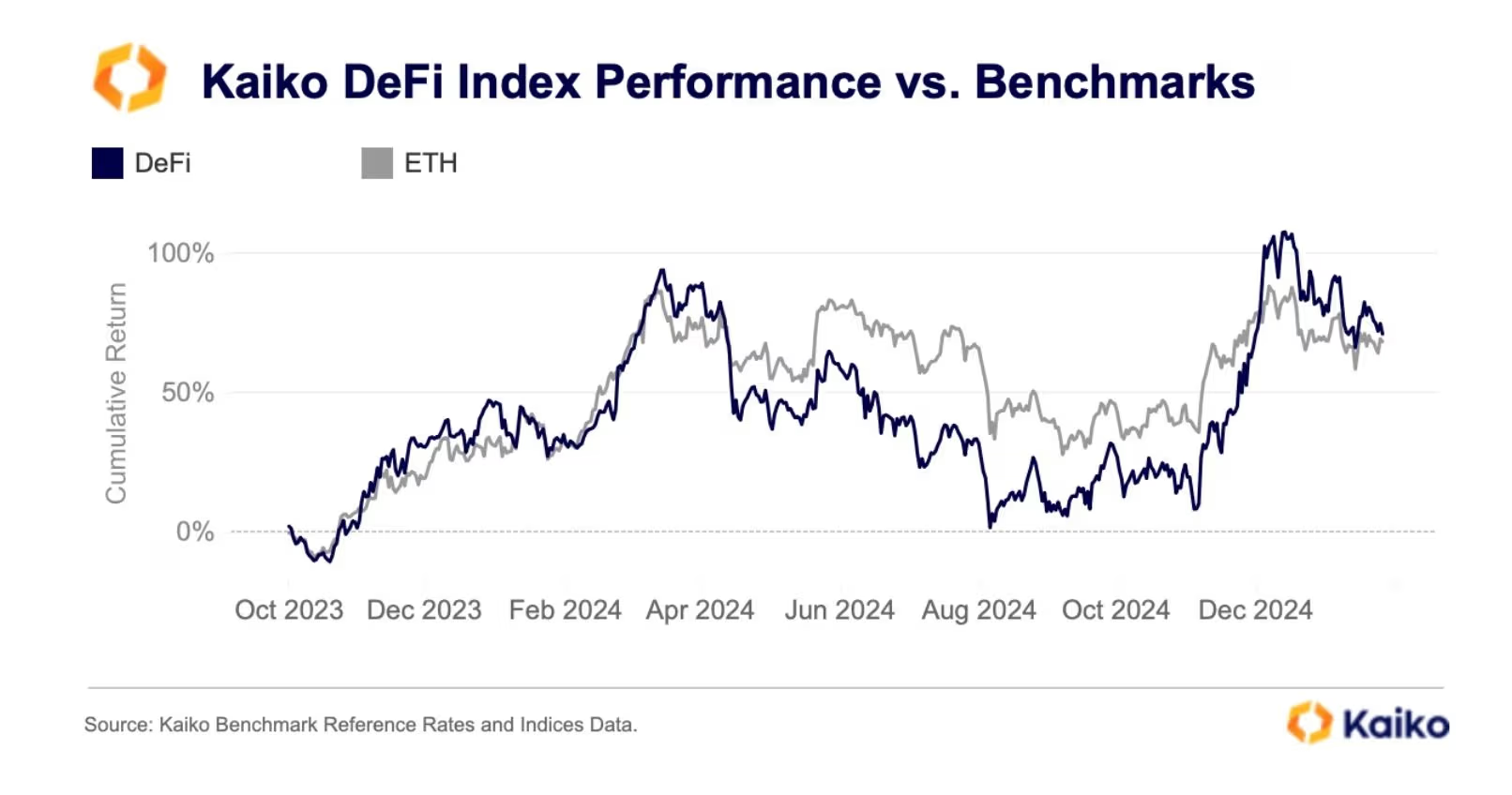

The company's DeFi Index (KSDEFI) has outperformed Ethereum (ETH) since its inception in October 2023, delivering roughly 75% gains over that period. This is especially notable given that most of the protocols included in the index operate on Ethereum.

“This outperformance could continue into the second half of 2025 as several assets in the index benefit from strong tailwinds,” the report states. “This trend highlights the decreasing correlation between the DeFi Index and ETH over time as the decentralized finance sector continues to evolve outside of the Ethereum ecosystem.”

The index includes 11 DeFi tokens, with UNI, AAVE, and ONDO being the most significant. At least four of these tokens have strong tailwinds for the rest of the year, according to the report.

For example, regulatory changes in the US could open up new opportunities for decentralized exchange Uniswap and decentralized lender Aave by allowing them to implement fee switching for each of their tokens, meaning that protocol fees could eventually be shared between UNI and AAVE holders.

The report also mentions that Ondo Finance's tokenization protocol is in turn likely to benefit from the accelerating tokenization trend as Wall Street dives deeper into cryptocurrency.

“Regulatory restrictions in key markets have been a major hurdle [since 2020], but that’s only part of the problem. DeFi also faces structural challenges, including significant resistance from users due to fees and security issues. However, with regulatory oversight loosening, the sector now has multiple growth opportunities,” the report said.