Bitcoin’s Coinbase Premium Indicator Shows Overseas Buyers Taking the Lead Ahead of CPI Release

BTC buyers over Binance seem to be leading the BTC price action ahead of the CPI release.

Updated Feb 12, 2025, 8:07 a.m. UTCPublished Feb 12, 2025, 8:04 a.m. UTC

What to know:

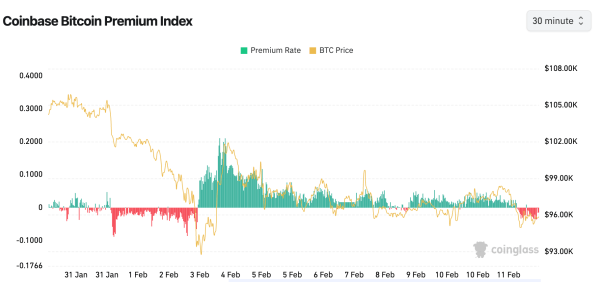

- BTC's Coinbase premium indicator tracked by Coinglass has flipped negative for the first time since the Aug. 3 price crash.

- It's a sign that traders over the Nasdaq-listed exchange have turned cautious ahead fo the CPI release.

Bitcoin's (BTC) Coinbase premium indicator, which measures the spread between BTC's dollar-denominated price on the Coinbase exchange and tether-denominated price on Binance, has flipped negative for the first time since the Feb. 3 crash, according to data source Coinglass.

It's a sign that traders over the Nasdaq-listed exchange have turned cautious ahead of Wednesday's U.S. CPI release, and their offshore counterparts have led the price recovery from overnight lows near $94,900 to $96,000.

Historically, bull runs have been marked by prices trading at a premium on Coinbase, indicating strong leadership from U.S. investors. The premium soared to two-month highs in early November as BTC rose into its the-then uncharted territory above $70,000.