What Crypto Narratives to Watch This Week

This week, three areas of the crypto industry were in the spotlight: AMM, trading bots, and perpetual futures.

Automated market makers (AMM) protocols UNI, CAKE, and PENDLE are on the rise after Uniswap’s Unichain launched and BNB’s position strengthened; trading bots are showing impressive results: Photon and BullX earned more in fees than the Ethereum network in a week. Hyperliquid is leading the perpetual contract platforms, and HYPE is soaring in value.

Automated Market Makers (AMMs)

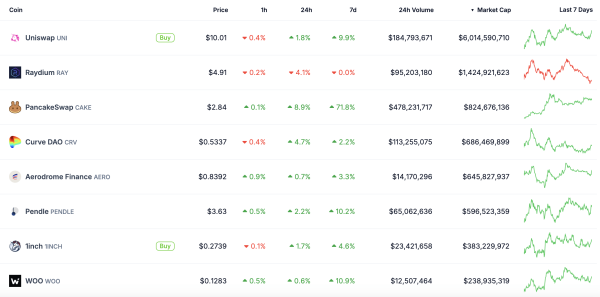

Automated market maker (AMM) protocol tokens UNI, CAKE, PENDLE, and WOO all saw significant gains last week, making them among the hottest trends. The launch of Unichain boosted Uniswap, while BNB’s surge helped CAKE gain 70%.

AMMs are decentralized protocols that allow trading without an order book. Instead, liquidity pools are used: traders exchange assets through these pools, and liquidity providers receive commissions.

RAY is worth mentioning separately. Despite the sideways price movement, the protocol remains profitable. In a month, it earned $270 million in fees. Solana is in a downward trend, but a new wave of interest in memecoins on this network may support RAY due to its strong performance.

Trading Bots

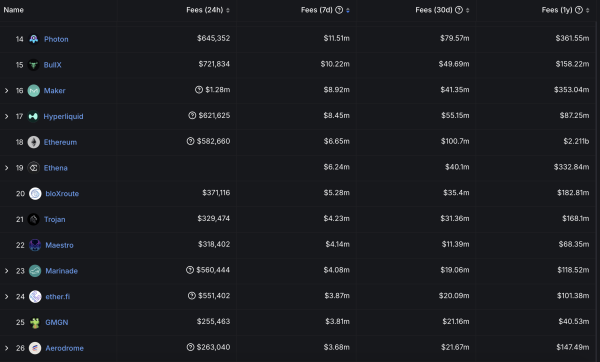

Trading bots are considered one of the main trends in the crypto industry since the end of 2023. Five such projects are in the top 25 in terms of revenue among all crypto protocols, attracting hundreds of thousands of users daily.

These automated programs make trades according to specified strategies without human intervention. Most bots work via Telegram, some are also available in desktop versions.

Over the past week, sector leaders have shown impressive results:

- Photon and BullX earned over $10 million in fees, overtaking Ethereum ($6.6 million).

- Trojan, Maestro and GMGN each brought in over $3 million.

Despite Solana's price drop, trading bots are growing in popularity. Analysts predict the number of coins will increase to 1 billion by 2030, which could support projects like BonkBot and BananaGun with their BONK and BANANA tokens.

Perpetual contracts

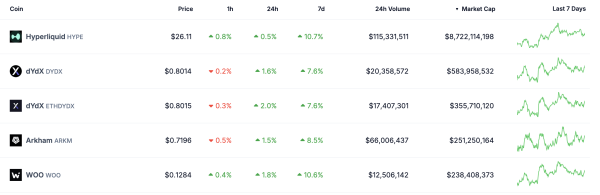

The top 5 tokens of perpetual futures trading platforms have shown growth in the week. The sector leader, HYPE, has gained more than 10% after several weeks of decline.

These platforms allow trading perpetual contracts with leverage. Traders can open long or short positions, and a special financing mechanism maintains the contract prices at the spot market level.

Hyperliquid maintains its leadership in the sector: the platform earned $8.45 million in commissions in a week. HYPE remains the largest player in terms of capitalization and revenue, but its dominance may attract new competitors. A similar situation was observed with trading bots: BONK, BANANA and Maestro lost market share to new projects – Trojan, BullX and Photon.

Источник: cryptocurrency.tech