These two signals indicate that Bitcoin (BTC) bulls are not giving up

Since August 25, Bitcoin has been trying to overcome the resistance at $112,000. Every time it approaches this threshold, a sell-off begins

Despite these challenges, some investors remain confident. Instead of retreating, they continue to accumulate BTC, which supports optimism about the asset’s imminent recovery.

Bulls Dominate Bitcoin Market

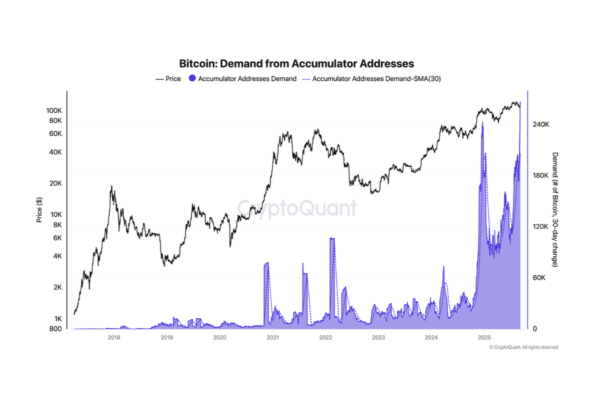

According to a new report from anonymous CryptoQuant analyst Darkfost, demand for BTC accumulator addresses is “growing rapidly.” These are wallets that have made at least two transactions with a minimum amount of BTC without selling a single coin. They have now reached a new all-time high in their holdings.

“We see this type of address associated with long-term holding behavior. In the era of corporate treasuries and growing acceptance of Bitcoin as a store of value, many BTC are being accumulated with the intention of holding them for the long term,” Darkfost noted.

Demand for Bitcoin accumulator addresses. Source: CryptoQuant

Demand for Bitcoin accumulator addresses. Source: CryptoQuant

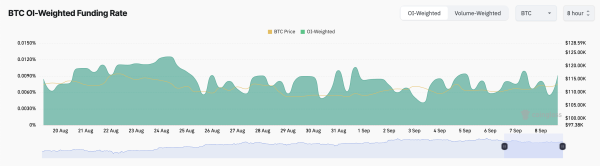

Additionally, the BTC funding rate on major exchanges remains positive despite recent weak performance. According to Coinglass, it is 0.0091%, meaning that traders with long positions are paying traders with short positions. This indicates that most traders are optimistic and expect growth.

Thus, BTC traders are willing to pay a premium for long positions, confirming the trend seen in accumulator addresses.

BTC Funding Rate. Source: Coinglass

BTC Funding Rate. Source: Coinglass

BTC Forecast: Where Will the Price Go?

Both retail investors and derivatives market participants remain optimistic. This may mean that it is only a matter of time before prices rise. If demand continues to grow, the coin’s price will reach $115,892.

BTC Price Analysis. Source: TradingView

BTC Price Analysis. Source: TradingView

However, if the sell-off resumes, BTC risks falling below $111,961 and reaching $110,034.

Source: cryptonews.net