Strategy, Greenlane, and BitMine have replenished their crypto reserves.

Publicly traded companies continue to accumulate cryptocurrency. Strategy, Greenlane Holdings, and BitMine Immersion Technologies announced additions to their reserves.

Publicly traded companies continue to accumulate cryptocurrency. Strategy, Greenlane Holdings, and BitMine Immersion Technologies announced additions to their reserves.

Strategy has acquired 168 BTC for ~$18.8 million at ~$112,051 per bitcoin and has achieved BTC Yield of 26.0% YTD 2025. As of 10/19/2025, we hodl 640,418 $BTC acquired for ~$47.40 billion at ~$74,010 per bitcoin. $MSTR $STRC $STRK $STRF $STRD https://t.co/UILBHXkA6a

— Michael Saylor (@saylor) October 20, 2025

Strategy acquired 168 BTC worth approximately $18.8 million. The average purchase price was approximately $112,051. On October 13, the price of digital gold recovered from its decline. The return on Bitcoin investments since the beginning of 2025 has reached 26%.

As of October 20, the firm holds 640,031 BTC. The total asset value is ~$71.15 billion, with an average entry price of ~$74,010.

The top 10 largest Bitcoin holders among public companies. Source: BitBo.

The top 10 largest Bitcoin holders among public companies. Source: BitBo.

Greenlane Holdings announced a $110 million private placement. The funds will be used to finance a treasury strategy focused on purchasing Berachain (BERA) tokens. The round was led by Polychain Capital, with participation from other investors.

BitMine acquired 203,826 ETH over the past week. The company's total cryptocurrency and cash reserves reached $1.34 billion. These include 3.24 million ETH, 192 BTC, $219 million, and $119 million in Eightco Holdings shares.

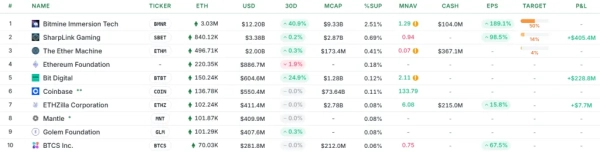

The top 10 largest Ethereum holders among public companies. Source: Strategic ETH Reserve.

The top 10 largest Ethereum holders among public companies. Source: Strategic ETH Reserve.

As a reminder, BitMine Chairman Tom Lee announced that the crypto treasury bubble had burst.

Bit Digital CEO Discusses DAT Companies' Survival Strategies in a Bear Market

Source: cryptonews.net