Strategy bought $22 million worth of Bitcoin and now owns more than 640,000 BTC.

Michael Saylor's Strategy Inc., the world's largest public holder of Bitcoin, increased its holdings of the cryptocurrency after the price of BTC fell below $110,000 last week.

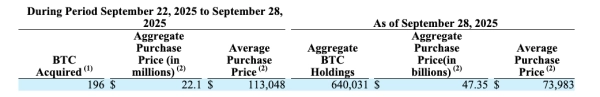

Strategy purchased 196 bitcoins for $22.1 million during the week ending Sunday, according to a U.S. Securities and Exchange Commission filing Monday.

The purchase was made at an average price of $113,048 per coin, according to CoinGecko, as BTC started the week above $112,000 and fell below $110,000 on Thursday.

Following the acquisition, Strategy has a total of 640,031 BTC, purchased for approximately $47,350,000,000 at an average price of $73,983 per coin.

Saylor expects Bitcoin to rise by the end of the year

Strategy's latest $22 million Bitcoin purchase is one of the smallest weekly BTC purchases the company has made to date, signaling a continued slowdown in purchases and a reduction in the number of acquisitions in recent months.

Last week, Strategy co-founder Michael Saylor predicted that Bitcoin would begin to rally by the end of 2025 after a period of pressure from institutional adoption.

Figure 1. Excerpt from Form 8-K strategy filing. Source: SEC.

“I think as we overcome some of the recent resistance and some macro headwinds, we'll see Bitcoin start to rally strongly again by the end of 2025,” Saylor said.

Strategy shares fell to a 6-month low

In addition to the pressure caused by Bitcoin price volatility, Strategy's common stock, MSTR, is also declining.

MSTR fell to $300.70 on Wednesday, its lowest since mid-April and a six-month low for Strategy shares, according to TradingView data.

CryptoQuant analyst Maartunn, who noted that the stock hit $300 on Monday, said MSTR's drop is “a painful move for the largest corporate holder of Bitcoin.”

Figure 2. Source: Maartunn.

While many were concerned about Strategy's stock's decline amid the Bitcoin price decline, some observers emphasized that the stock still has significant growth potential over the long term.

“Holding MSTR is not for the faint of heart,” growth strategist Julius wrote last week, referring to MSTR's 30% decline in the current cycle and its 56% drop in April 2025. “Despite these declines, MSTR is still up 2,300% in this bull market.”

According to TradingView, MSTR has lost 2.9% of its value over the past six months at press time, but is up 96% over the past year, with a 2,000% gain over the past five years.

Source: cryptonews.net