Short-Term Investors Are Buying Bitcoin (BTC) on the Dip

At press time, Bitcoin is trading at around $113,600, down 1.3% from 24 hours ago. Traders are worried about further declines, but some investors are confident of a short-term rebound.

Let's figure out what's happening in the Bitcoin (BTC) market and what to expect from the cryptocurrency price.

Short-Term Holders Buy Bitcoin on the Dip

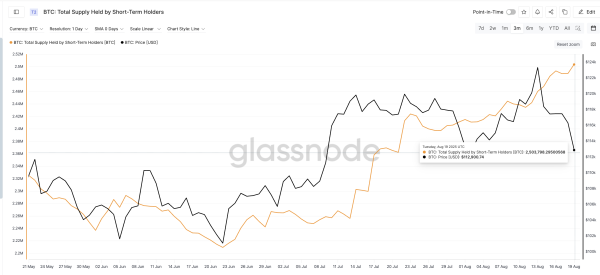

In recent days, short-term holders who bought Bitcoin over the past 155 days have increased their holdings despite the price drop. They now hold 2,503,798 BTC, up from 2,460,514 BTC a week ago.

They accumulated over 43,000 BTC during the sharp price decline from $123,000 to $112,000. At the time of writing, their holdings have reached a 3-month high.

Bitcoin Price and Short-Term Holder Stocks: Glassnode

Bitcoin Price and Short-Term Holder Stocks: Glassnode

This trend is reminiscent of early June, when the price of Bitcoin fell from $105,900 to $104,700 and short-term holders increased their holdings from 2,275,000 BTC to nearly 2,287,000 BTC. Since then, the price of Bitcoin has risen to $110,000.

When new holders increase their holdings during a price decline, it often indicates their confidence in an imminent rebound.

They sell at a loss, but still buy

Short-term holders are willing to take losses by buying up new BTC dips in anticipation of a rebound. On August 18, the short-term holders’ spent output profit ratio (SOPR) fell to its lowest in over a month, below 1. This means that, on average, the coins spent by this group were sold for less than they were bought for. In other words, they are selling at a loss.

SOPR, or Spent Output Profit Ratio, compares the selling price of Bitcoin to the buying price. When the SOPR for short-term holders drops below 1, it means that this group is, on average, taking a loss.

Short-Term Holders' SOPR Falls to Monthly Lows on Aug 18: CryptoQuant

Short-Term Holders' SOPR Falls to Monthly Lows on Aug 18: CryptoQuant

This is often considered a bottom signal. In early August, a similar drop in SOPR (from 1.00 to 0.99) occurred before Bitcoin rose from $114,000 to a new high of around $123,000. Selling at a loss then showed that short-term holders had capitulated, which was a necessary jolt before the rally began.

While some holders are taking losses, the overall volume in short-term wallets continues to grow. This situation, where more buyers are entering the game while some are selling at a loss, indicates a change in sentiment. This is not panic selling.

BTC Price Recovery Depends on One Level

Bitcoin price is still under pressure, but there are signs of a possible reversal. Today, the price has slightly increased to $113,600, but remains 1.3% lower on the 24-hour chart. Strong support is around $111,900. If this level holds, a recovery could soon begin.

Bitcoin Price Analysis: TradingView

Bitcoin Price Analysis: TradingView

On the downside, immediate resistance lies around $114,600. The next major hurdles are at $116,715 and $118,197; the latter serves as a key turning point from previous local highs. A break above $118,200 would confirm that momentum is back on the bulls’ side.

When this situation has arisen in the past with short-term holders, the rise in short-term supply and negative SOPR has often indicated a local bottom. In the previous case, this led to a rally of over $10,000 in a matter of days.

If the current trend continues, the price of Bitcoin could soon head higher. However, if it falls below $111,900, a more significant correction is possible, which would cast doubt on the optimistic forecast.

Source: cryptonews.net