Here's Why This September Could Be Good For Bitcoin (BTC)

September is traditionally a tough month for Bitcoin (BTC), as its price often falls during this period. However, some experts expect growth, pointing to a decline in reserves on exchanges as a signal for growth.

The optimism remains despite Bitcoin's recent struggles. The world's largest cryptocurrency has fallen 2% over the past week, reflecting the overall uncertainty in the market.

What's in Store for Bitcoin This September

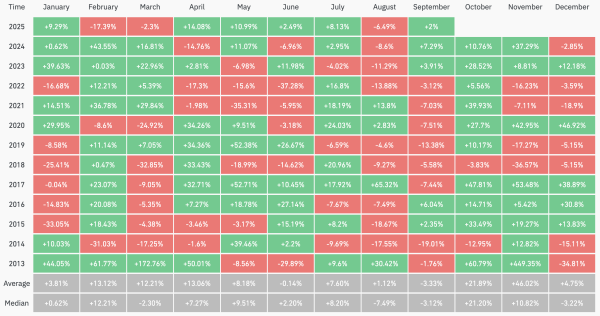

According to Coinglass, Bitcoin's average return in September was -3.33%, making it the worst month for the cryptocurrency. BTC has ended the month in the red for six years in a row from 2017 to 2022.

Bitcoin Monthly Dynamics. Source: Coinglass

Bitcoin Monthly Dynamics. Source: Coinglass

Many experts agree with this view. One analyst described the current market as reminiscent of a “classic stock market peak,” indicating further corrections are possible.

Analyst Timothy Peterson reported that Bitcoin has fallen 6.5% in the past month. He predicts that the price will fluctuate between $97,000 and $113,000 by the end of September, confirming that the trend is continuing.

“It's part of a seasonal pattern that repeats itself over many years,” Peterson added.

#Bitcoin – Two possible scernarios for BTC

1) Green: If 108k support holds, the price will soon continue heading higher.

2) Red: If $108k support breaks, we might see a deeper retest of the upward-sloping trendline. pic.twitter.com/pyQTikXxfn

— Mags (@thescalpingpro) September 4, 2025

Many expect Bitcoin to rebound in the next quarter. October and November are traditionally considered strong months for the cryptocurrency, so this is quite possible.

“Historically, Bitcoin has always bottomed in September after the halving year. Then it usually starts a smooth rally. While I don't always rely on the past as an accurate signal, looking at the current charts, this could happen again,” Crypto Nova wrote in a post.

This view is supported by Benjamin Cohen, CEO of Into The Cryptoverse, who noted that September is often the low point in post-halving years, which is usually followed by a recovery to the peak of the market cycle in the fourth quarter.

Crypto analyst Rand noted that the amount of BTC on exchanges has been steadily declining, reaching a six-year low. This indicates that selling pressure is easing. If demand picks up, the supply squeeze could support a more positive outlook for Bitcoin.

“Bullish supply shock,” Cade Bergmann added in the post.

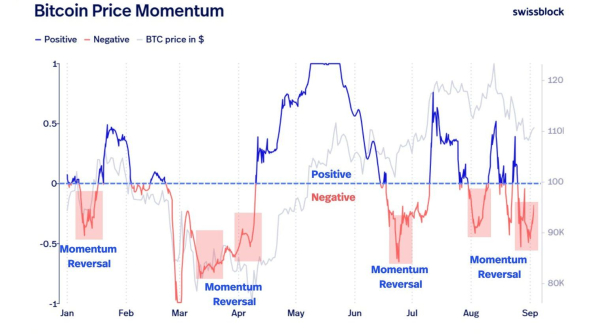

Rand also noted that market sentiment is shifting from negative to positive, which could signal a possible trend change. Two weeks before the Fed's expected rate cut, the analyst suggested that the policy change could be a catalyst for a stronger recovery in September.

Bitcoin Momentum. Source: X/CryptoRand

Bitcoin Momentum. Source: X/CryptoRand

Market watchers are also keeping an eye on key dates. Analyst Marty Pati pointed to September 6 as a possible trigger related to market maker activity.

“Bitcoin market makers are active on the 6th of every month. In my opinion, September 6th is the move. It's a window of action until September 17th, when the FOMC meeting takes place,” he said.

#Bitcoin is only 1.7% of global unbacked fiat. That means 98.3% of the currency supply is still waiting to be disrupted. WE ARE SO EARLY. pic.twitter.com/Bh2Zi2v89p

— Carl ₿ MENGER

(@CarlBMenger) September 3, 2025

Bitcoin price is currently under pressure, and experts are unsure whether September will be the bottom or the decline will continue. The coming weeks, especially in anticipation of the Fed's decision, will be key to understanding whether the cryptocurrency can overcome seasonal weakness and take advantage of the current supply dynamics.

Source: cryptonews.net