Gold's Record September Rise Could Send Bitcoin (BTC) To $185,000

In September 2025, gold continued to rise for the fourth week in a row, reaching a new record of $3,659 per ounce. Bitcoin investors watched the situation with interest, expecting BTC to start rising as well, as the connection between the two assets became more and more noticeable.

However, capital flows may be more complex than they seem. Rising precious metal prices are diverting some of investors' attention away from Bitcoin.

Experts predict further growth of gold

Black Swan Capitalist expert Versan Aljarra, citing data from Crescat Capital on social media X (formerly Twitter), noted that foreign central banks now hold more gold than US Treasuries for the first time since 1996. He predicts that gold could rise to $4,000 and beyond.

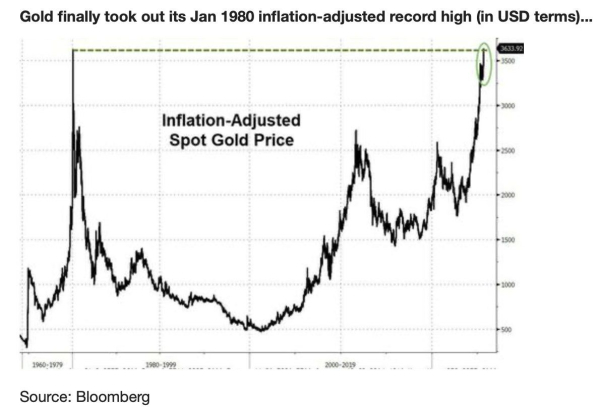

EndGame Macro analyst explained in X that gold has surpassed its inflation-adjusted peak in 1980, completing a 45-year period.

Inflation-adjusted spot price of gold. Source: Barchart

Inflation-adjusted spot price of gold. Source: Barchart

These developments are not random. They reflect a decline in confidence in the monetary system due to rising U.S. debt, doubts about the credibility of the Federal Reserve, geopolitical tensions, and record purchases by central banks in emerging markets.

“Gold is rising not because of love for the shiny metal, but because trust in the system is weakening,” EndGame Macro told.

Ray Dalio, founder of Bridgewater Associates, warned of stagflation caused by global debt. He noted that the financial system depends on converting debt into money. However, the shortage of cash makes the devaluation of the US dollar more attractive. As a result, gold is expected to rise.

Gold's Rise Brings New Hope for Bitcoin

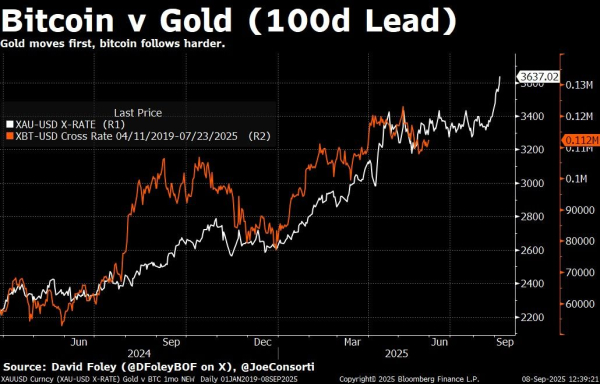

Bitcoin analyst Joe Consorti noted that gold typically leads BTC by 100 days, as it has 10 times more liquidity and is more widely distributed. Some analysts use a 90-day lag instead of a 100-day lag. However, in general, Bitcoin usually follows gold by three months.

Bitcoin vs. Gold (100-Day Lead) Source: Joe Consorti

Bitcoin vs. Gold (100-Day Lead) Source: Joe Consorti

This view sees BTC as an “echo” of gold. With the first rate cut expected next week, Q4 2025 promises strong growth.

“BTC is an echo boom. First rate cut next week. Q4 setup looks great,” predicted Consorti.

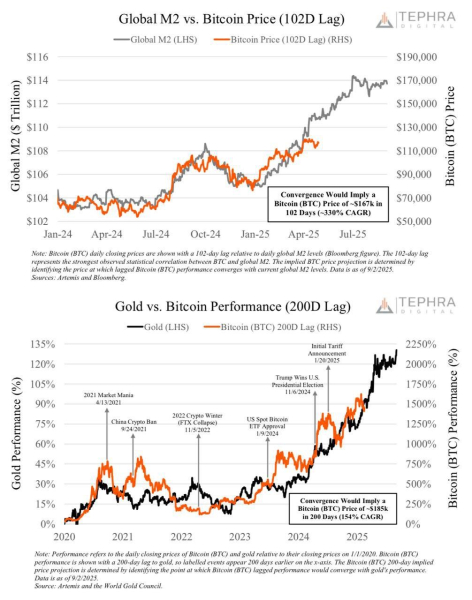

Tephra Digital supported this view by examining Bitcoin’s correlation with the global M2 supply. Their chart showed that BTC follows the M2 expansion with a 102-day lag and gold’s growth with a 200-day lag.

Global M2, Gold and Bitcoin. Source: Tephra Digital

Global M2, Gold and Bitcoin. Source: Tephra Digital

“If Bitcoin's correlations with M2 and gold hold, the rest of the year could be very interesting. The charts below point to $167K-$185K,” Tephra Digital LLC shared its forecast.

While the technical outlook varies slightly, Joe Consorti and Tephra Digital are confident in the future of gold and Bitcoin.

Despite the optimism, some concerns remain. Silver recently topped $41, its highest since 2012. This has sparked debate that gold and silver could attract more capital than BTC, which could shift investment into precious metals.

“Capital appears to be starting to flow away from assets that have soared, such as Bitcoin, and into traditional safe havens, such as precious metals,” said LBroad investor.

In addition, economist Peter Schiff pointed out that Bitcoin, when valued in gold, is now about 16% below its peak in November 2021. This points to a trend where investors prefer precious metals to assets like Bitcoin.

Source: cryptonews.net