Financial institutions are embracing “depreciation trading” in favor of Bitcoin and gold.

Institutions have a new concept called “depreciation trading” that will protect them, entrepreneur Anthony Pompliano said on a podcast.

This is something gold bugs and Bitcoiners have been talking about for years, and now institutions have just realized that “nobody will ever stop printing money,” he added.

“It seems like there's no longer any debate about this. People understand that the dollar and bonds will have a very difficult time going forward, and therefore Bitcoin and gold will undoubtedly win.”

Short selling is an investment strategy based on the expectation that fiat currencies will lose purchasing power over time due to monetary expansion caused by money printing by central banks.

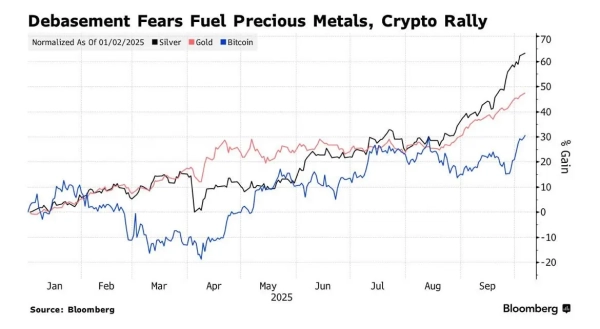

Investors are investing in assets they believe will maintain or increase in value as traditional currencies depreciate, such as gold, which has risen 50% since the start of the year, and Bitcoin.

“We've long wanted wealth managers and financial advisors to start using Bitcoin as a tool for investing in their portfolios,” ProCap BTC Chief Investment Officer Jeff Park told Pompliano.

Short-term trading is the “dark matter of finance”

Bitwise Chief Investment Officer Matt Hougan shared his thoughts on short selling on Thursday, saying it's “the dark matter of finance. You can't touch it, but it affects everything.”

“The recognition of the 'debasement trade' is accelerating for a simple reason: deficits are growing, debt is accumulating, and accommodative policy is suppressing real returns,” commented Brian Kubellis, chief strategy officer at Onramp Bitcoin.

“Investors expecting continued dilution are looking for a benchmark that will not change, and this search is evident in both gold and Bitcoin.”

Fear of devaluation is fueling the cryptocurrency rally. Source: Bloomberg

Not just digital gold

Bitcoin is more than just digital gold, Enrique Ho, CFO of Blink Wallet, said in an interview with X.

“It's designed to be anti-debasement from the ground up: fixed supply, transparent issuance, and trustless verification,” Ho said, adding that it's “the purest form of capital preservation in a world where money itself is overvalued.”

“This is a trade in depreciation – and it will define the next decade.”

The US dollar continues to fall

The decline in the US dollar is clearly reflected in the US dollar index (DXY), which measures its exchange rate against a basket of currencies.

It has fallen about 12% this year, from a high of 110 in January to a three-year low of 96.3 in mid-September, before recovering slightly in October, according to TradingView.

The DXY has been trending downward for the past three years. Source: TradingView

Source: cryptonews.net