BlackRock ETF investors return to profits as price recovers to $90,000

Owners of BlackRock's largest spot Bitcoin fund, iShares Bitcoin Trust ETF (IBIT), returned a combined profit of $3.2 billion on Wednesday, according to data from blockchain platform Arkham.

“BlackRock IBIT and ETHA holders' holdings have grown from nearly $40,000,000,000 at the PnL peak on October 7th to $630,000,000 four days ago,” Arkham wrote in a Wednesday X post. “This means the average size of all BlackRock ETF purchases has almost reached breakeven.”

With ETF holders no longer under pressure, the pace of Bitcoin ETF selling may continue to slow, although there has been a significant improvement since the $903 million outflow recorded on November 20.

Figure 1. BlackRock IBIT Bitcoin ETF owners, unrealized profit/loss ratio, 3-month chart. Source: Arkham.

Bitcoin ETFs saw inflows for two days in a row for the first time in two weeks, with cumulative inflows on Wednesday amounting to a modest $21 million, according to Farside Investors.

The development is a positive sign for Bitcoin, as BlackRock's Bitcoin ETF became the only fund to record net positive inflows in 2025, according to K33 Research.

Figure 2. Source: Vetle Lunde.

“ Inflows from spot Bitcoin ETFs have become the main driver of Bitcoin's growth in 2025, “ said Jeff Kendrick, head of digital asset research at Standard Chartered.

BlackRock is the largest asset manager, with $13.5 billion in assets under management as of Q3 2025.

Bitcoin ETF investors are no longer under pressure amid growing interest rate cut expectations.

The broader Bitcoin ETF investor base also returned to profits after Bitcoin climbed above the key flow-weighted level of $89,600, a level it lost two weeks ago.

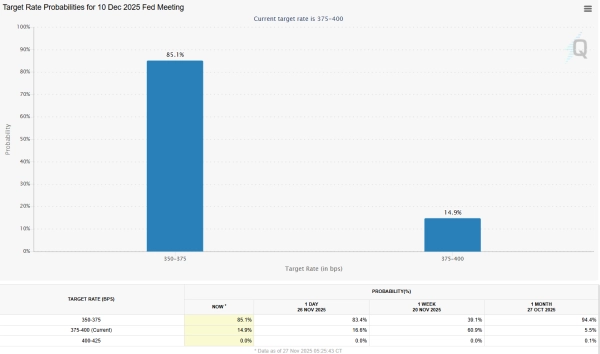

Bitcoin's recovery followed a sharp rise in expectations for an interest rate cut at the US Federal Reserve's December 10 meeting, with the likelihood of such a cut rising by 46% in a week.

Figure 3. Probability of an interest rate cut. Source: CMEgroup.com.

Markets are pricing in an 85% chance of a 25 basis point rate cut, up from 39% a week ago, according to CME Group's FedWatch tool.

According to Glassnode analyst Sean Rose, two weeks ago, Bitcoin's price correction sent Bitcoin ETF holders' value down to around $89,600 on a flow-weighted basis. The average holder suffered a paper loss on their investment.

However, most ETF holders are “long-term allocators,” meaning that “a dip doesn't lead to a quick exit,” Vincent Liu, chief investment officer at Kronos Research, a trading analytics firm, said in an interview.

Source: cryptonews.net