Bitwise: 48 new Bitcoin treasuries emerged in Q3

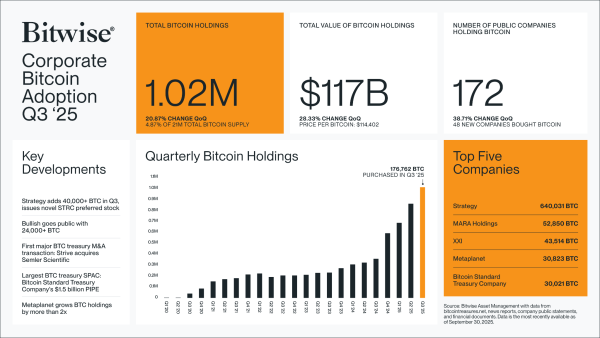

From July to September, the number of public companies holding Bitcoin (BTC) increased by 38% to 172, according to calculations provided by Bitwise, citing BitcoinTreasuries.NET.

Over the same period, the estimated value of digital gold reserves increased by 28.3% to $117 billion. The supply of Bitcoin increased by 20.9% to 1.02 million BTC, equivalent to 4.87% of the supply.

Bitwise CEO Hunter Horsley called the figures “absolutely remarkable.”

Source: Bitwise.

Source: Bitwise.

On the topic: Fidelity estimates the volume of illiquid bitcoins in seven years

The role of corporations

Michael Saylor's Strategy retains its leading position with 640,250 BTC ($72 billion). MARA Holdings is second with 53,250 BTC ($5.99 billion), and XXI is third with 43,514 BTC ($4.9 billion).

Source: BitcoinTreasuries.NET.

Source: BitcoinTreasuries.NET.

“As more corporations and even individual governments express interest, this momentum will continue, especially as regulatory clarity improves and the necessary infrastructure is established,” commented BTC Markets analyst Rachel Lucas.

She said such participation helps legitimize digital gold as a mainstream asset class and lays the groundwork for broader financial innovations, from “loans backed by the first cryptocurrency to new derivatives markets.”

On the topic: Metaplanet registered subsidiaries in the US and Japan to increase Bitcoin revenue.

When is the bull run?

Lucas attributed the lack of impact of corporate purchases on the digital gold price to the use of over-the-counter (OTC) platforms, which “avoids slippage and volatility.” However, she clarified that this also means that the transactions have no immediate impact on the price.

Edward Carroll, head of markets at MHC Digital Group, said such actions would ultimately create an imbalance in supply and demand, “which should put significant pressure on prices in the medium to long term.”

As a result, demand will be “orderly and growing in the coming years,” allowing the first cryptocurrency to “de-coup from risk/sentiment as institutional interest grows.”

According to BiTBO, miners generate an average of ~900 BTC per day. According to River, in 2025, companies added 1,755 BTC per day, and ETFs added another 1,430 BTC per day.

On the topic: The era of “easy money” for crypto treasuries has come to an end — Coinbase

The “coming of age” of Bitcoin

Beyond corporations, exchange-traded funds (ETFs) are also accumulating digital gold, marking a “significant shift and an important step toward mass adoption,” Lucas said.

Spot Bitcoin ETFs raised $2.67 billion last week.

“We are witnessing a maturation of the market. Cryptocurrency is evolving from a speculative marketplace to a legitimate asset class with institutional investors,” she concluded.

Related: TradFi to Increase Bitcoin Holdings by Year-End — Wall Street Veteran

Source: cryptonews.net