Bitcoin will continue to rise, but will first pull back by 2%: what to expect from BTC

Bitcoin's price remains stable after its recent rally. At press time, it was trading around $117,100, up 1.3% over the past 24 hours and 3% over the week. The breakout from the head-and-shoulders pattern still points to further gains.

We'll explore what's happening in the Bitcoin (BTC) market and what to expect from the cryptocurrency's price.

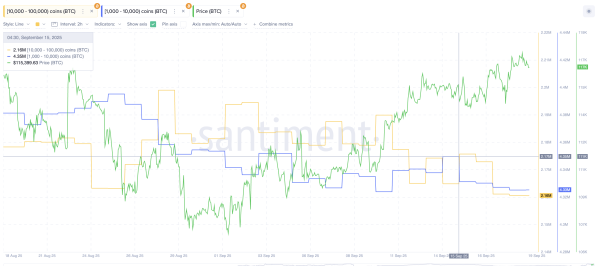

Selling pressure is increasing due to large holders

The two largest groups of Bitcoin wallets have been reducing their holdings since September 15. These groups, known as whales and sharks, hold between 1,000 and 10,000 BTC and between 10,000 and 100,000 BTC, respectively.

- The 1,000-10,000 BTC group reduced their holdings from 4.35 million BTC to 4.33 million BTC.

- The 10,000-100,000 BTC group decreased its holdings from 2.17 million BTC to 2.16 million BTC.

Selling Bitcoin from Major Holders: Santiment

Selling Bitcoin from Major Holders: Santiment

This represents a net outflow of approximately 30,000 BTC in just four days. With Bitcoin currently trading above $117,000, nearly $3.5 billion in BTC has been withdrawn from holdings. Such dynamics often indicate that large investors are taking profits or bracing for volatility.

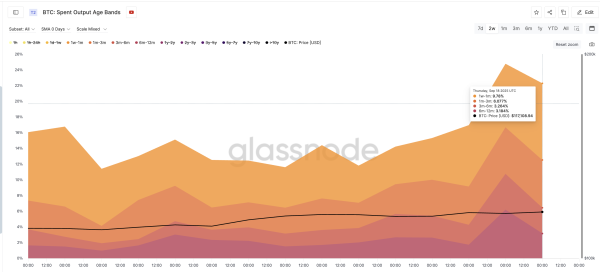

Young coins are actively sold

Another important on-chain signal confirms this picture: the age bands of spent outputs. This metric tracks what percentage of coins from different “age bands” are being moved or sold. It indicates what portion of the supply, moved weeks or months ago, is now being spent again.

Over the past two weeks, each younger age group has increased their share of coins spent:

- Holders from 1 week to 1 month: from 8.72% to 9.78%.

- Holders from 1 to 3 months: from 3.67% to 6.08%.

- Holders from 3 to 6 months: from 2.04% to 3.26%.

- Holders from 6 to 12 months: from 1.64% to 3.18% (relatively young given BTC history).

Bitcoin is actively spent among various groups: Glassnode

Bitcoin is actively spent among various groups: Glassnode

These groups are considered “young” because they bought or moved their coins within the last year. Unlike long-term holders who hold Bitcoin for years, young holders are quicker to sell their coins when the price rises.

The increase in all four categories indicates that more short- and medium-term holders are willing to sell their holdings. This coincides with selling among large groups of holders, creating a clear picture of short-term supply pressure.

BTC Forecast: Momentum Undetermined

The overall technical picture remains positive. Bitcoin broke out of the inverse head and shoulders pattern on September 10 and has held the breakout level since then. As long as the Bitcoin price is above $114,900, the immediate upside target is $120,800.

Bitcoin Price Analysis: TradingView

Bitcoin Price Analysis: TradingView

However, in the short term, a decline to $114,900 is more likely, as RSI data points to a new risk. From August 22 to September 18, Bitcoin's price made lower highs, while the RSI showed higher highs.

This hidden bearish divergence often signals a slowdown in momentum, leaving room for a short-term 2% retracement (the immediate and strongest support level).

If Bitcoin's price falls below $114,900, the pullback risks extending to $110,000. A daily close below this level would weaken the bullish structure.

Source: cryptonews.net