Bitcoin surpasses $118,000, Citi forecasts $133,000, and Robinhood promotes tokenized finance

- Bitcoin broke through $118,000 after closing above $117,000, shedding $590 million in shorts.

- US exchange shutdown stress and Uptober momentum push cryptocurrency cap above $4 trillion

- Citi sets year-end BTC target at $133,000 as Robinhood CEO backs tokenization

US government shutdown stress met with Bitcoin price surge

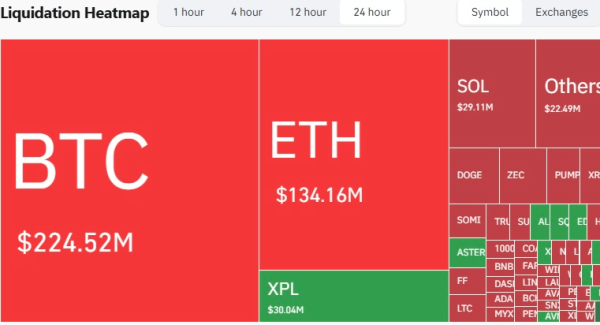

On October 2, the second day of the US government shutdown began, and Bitcoin responded with its highest daily close since August 15, closing above $117,000. This rally forced short sellers to cover their positions, and, according to CoinGlass, more than $590 million in liquidation occurred in the crypto market in 24 hours.

Source: CoinGlass

Source: CoinGlass

This decline helped push the total cryptocurrency market capitalization above $4 trillion. For traders, the combination of political gridlock in Washington and a clear breakout on the charts gave October momentum, which many are calling “Uptober.”

BTC technical breakout above $117,000

On the daily chart, the BTC/USD pair bounced off the 100-day simple moving average and broke through the descending resistance line that had remained intact since mid-August.

According to TradingView, the rise above daily resistance at $117,000 marked a technical shift, with volume confirming stronger confidence in a breakout.

Source: TradingView

Source: TradingView

Wall Street's top mid-term cryptocurrency predictions

Citi revises Bitcoin forecasts

Citigroup Inc. (NYSE: C), one of the “Big Four” US banks, has published its year-end Bitcoin forecast. The bank's BTC targets are as follows:

- The year-end target is $133,000, up from $135,000.

- The 12-month goal has been increased to $181,000.

- Bear's base target is $83,000.

Citi expects underlying Bitcoin cash inflows to reach approximately $7.5 billion by the end of this year. The bank noted that Bitcoin will continue to demonstrate an optimistic outlook in 2026, supported by significant demand from institutional investors seeking to hedge against inflation.

Related: Will Altcoins ETH, XRP, and SOL Ride Bitcoin's Shutdown-Fueled Momentum?

Robinhood is pushing tokenized finance.

At the Token2049 conference in Singapore, Vlad Tenev, CEO of Robinhood, told a crowd of crypto enthusiasts that real-world asset tokenization (RWA) will bridge the gap between web3 and traditional finance.

“Cryptocurrencies and traditional finance existed in different worlds, but they will merge completely. In the future, everything will be processed through the blockchain in one form or another, and the distinction will disappear,” Tenev noted.

Robinhood has already launched tokenized stock trading in Europe, making the American-based TradFi accessible to the global market. Tenev noted that the widespread adoption of tokenized assets may take longer than expected, as traditional mechanisms continue to operate, albeit with significant difficulties.

Related: Bitcoin (BTC) Price Prediction: Will Bitcoin Break $118K?

Source: cryptonews.net