Bitcoin Surpasses $116,000 After US CPI Release

Bitcoin rose above $116,000 after the release of the US Consumer Price Index (CPI), and traders were filled with optimism.

BTC/USD 1-day chart. Source: Bitstamp

BTC/USD 1-day chart. Source: Bitstamp

Inflation data strengthens bets on interest rate cuts

According to Bitstamp and TradingView, the BTC/USD rate rose to $116,358 on September 12. The August U.S. consumer price index (CPI) figures were in line with analysts' expectations, adding to the noticeable cooling in the producer price index (PPI) released the day before.

While the CPI hit its highest since January, it was the initial jobless claims data that grabbed the attention. The number came in at 263,000, versus the expected 235,000, the highest since October 2021.

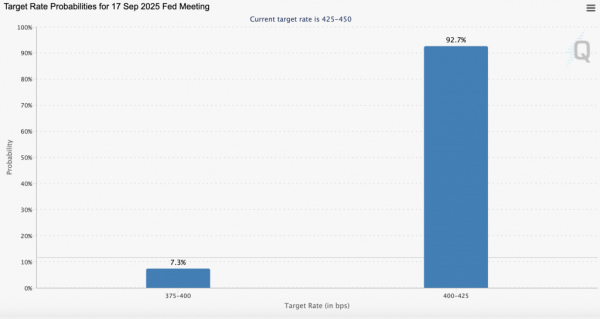

With concerns about labor market weakness continuing, bets that the Federal Reserve will cut interest rates at its September 17 meeting only increased after the CPI release, with markets even allowing for an 11% chance that the cut will be more than the minimum 0.25%.

“Markets are now pricing in a 75 basis point rate cut by year-end,” The Kobeissi Letter, a trading resource on social media site X, said. “While CPI inflation continues to rise, the labor market is too weak to ignore. Next week will be important.”

Crypto analysts see potential for growth

Cryptocurrency market commentators saw grounds for further price gains after Bitcoin broke above $116,000 for the first time since August 24.

“PPI is much lower than expected, CPI is as expected,” said trader Jelle. “Bottom line: inflation is not as bad as expected – let's cut rates later this month. The news is behind us, it's time to follow the plan: move up.”

BTC price predictions also highlighted the importance of the recent support gain. From a BitBull trader’s perspective, the key event was the $113,500 level turning from resistance to support, opening the door to a retest of the all-time high.

1-day chart BTC/USD. Analytics: BitBull

1-day chart BTC/USD. Analytics: BitBull

Markets are betting on easy monetary policy

Markets are now pricing in a high probability of a rate cut at the Fed's Sept. 17 meeting, according to the Chicago Mercantile Exchange's CME FedWatch Tool. Employment data continues to be a concern for policymakers despite relatively stable inflation figures.

Fed rate change probability. Source: Fedwatch

Fed rate change probability. Source: Fedwatch

The combination of subdued inflation data and signs of a weakening labor market is setting the stage for looser monetary policy. This has traditionally supported risk assets, including Bitcoin, as investors seek alternatives to low-yielding traditional instruments.

Source: cryptonews.net